Bacolod City News

and the World

Bacolod Real Estate Blog

Bacolod real estate news, blogs, articles

and investment advices

Philippine government has been curbing housing shortage since 2012 after the demand has reached an astonishing 1.3 Million, alarms has been detected before by housing

has reached an astonishing 1.3 Million, alarms has been detected before by housing organizations and real estate experts subsequent supply starts to decline from 220,756 to

organizations and real estate experts subsequent supply starts to decline from 220,756 to 200,124 units constructed based in 2009 record of HLURB Licensed to sell (LTS) database,

200,124 units constructed based in 2009 record of HLURB Licensed to sell (LTS) database, figures that hasn’t given much importance at the time for banks implements tights

figures that hasn’t given much importance at the time for banks implements tights borrowing policies and real estate developers just want to loosen up the real estate market

borrowing policies and real estate developers just want to loosen up the real estate market from over heating and most companies recuperates from the effect of world wide economic

from over heating and most companies recuperates from the effect of world wide economic crisis that brought down investments in chaos, The aftermath of the collapse of sub-prime

crisis that brought down investments in chaos, The aftermath of the collapse of sub-prime mortgage crisis known as the “housing bubble” in the US in 2008 affects economies world

mortgage crisis known as the “housing bubble” in the US in 2008 affects economies world wide, the slump that brought by the Financial Crisis alters the perceptions on the stability

wide, the slump that brought by the Financial Crisis alters the perceptions on the stability of real estate market as a secured investment. Meanwhile in the Philippines, the supply of

of real estate market as a secured investment. Meanwhile in the Philippines, the supply of affordable homes in the country hasn’t keeping up with the demand since then, creating a

affordable homes in the country hasn’t keeping up with the demand since then, creating a vacuum for real estate market to breath and that trigger a renewed demand that benefit

vacuum for real estate market to breath and that trigger a renewed demand that benefit the Philippines Real Estate going to its 9th successive year growth according to Global

the Philippines Real Estate going to its 9th successive year growth according to Global Property Guide. Recent industry report; “Impact of Housing Activities on the Philippine

Property Guide. Recent industry report; “Impact of Housing Activities on the Philippine Economy" jointly completed by the Center for

Economy" jointly completed by the Center for Research and Communication of the University of

Research and Communication of the University of Asia and the Pacific (CRC-UAP) and Subdivision

Asia and the Pacific (CRC-UAP) and Subdivision and Housing Developers Association (SHDA), the

and Housing Developers Association (SHDA), the backlog have reached at 6.7 million in 2015, plus

backlog have reached at 6.7 million in 2015, plus with the new housing need for the growing

with the new housing need for the growing Philippine population rate of 1.84% per annum

Philippine population rate of 1.84% per annum (2000-2015 PH growth rate) and with a

(2000-2015 PH growth rate) and with a household size of 4.4 (Philippine Statistics

household size of 4.4 (Philippine Statistics Authority), approximately the additional demand

Authority), approximately the additional demand for the period 2016 to 2030 will reached 7.27

for the period 2016 to 2030 will reached 7.27 Million. HLURB record on housing production rate is unstable with the drop of 25.57% from

Million. HLURB record on housing production rate is unstable with the drop of 25.57% from 274,545 in 2017 to 204,344 units in 2018. With the production rate between; 200,000 to

274,545 in 2017 to 204,344 units in 2018. With the production rate between; 200,000 to 250,000 per year will only results to an accumulated production of 3.15 million in 15 years

250,000 per year will only results to an accumulated production of 3.15 million in 15 years and the Philippine Statistics Authority only shows 20 thousand to 30 thousand every

and the Philippine Statistics Authority only shows 20 thousand to 30 thousand every quarter year of building permit applications for residential construction assuming 100%

quarter year of building permit applications for residential construction assuming 100% occupancy rate and for 15 years getting the average would add up to only 1.5 Million.

occupancy rate and for 15 years getting the average would add up to only 1.5 Million. Without much more effort from the Philippine government and intervention from private

Without much more effort from the Philippine government and intervention from private sectors and institutions. The country would still needs a total of 9.32 million houses to

sectors and institutions. The country would still needs a total of 9.32 million houses to break-even, meeting 10 years earlier Philippine goal “Ambition Natin 2040” - decent house

break-even, meeting 10 years earlier Philippine goal “Ambition Natin 2040” - decent house for every Filipino household”

for every Filipino household” Basically, demand in housing is based on the household’s security of tenure and mostly on

Basically, demand in housing is based on the household’s security of tenure and mostly on how a growing family adjusts into their housing consumption given that places them in

how a growing family adjusts into their housing consumption given that places them in equilibrium, if the equilibrium has not meet; modification of existing units, relocating to a

equilibrium, if the equilibrium has not meet; modification of existing units, relocating to a bigger or adding another unit become an option to meet satisfaction and comfort for the

bigger or adding another unit become an option to meet satisfaction and comfort for the certain household,. As the trends continue the demand on housing rises but requires

certain household,. As the trends continue the demand on housing rises but requires enthusiasm, there desire to own and the actions from these consumers. Other factors that

enthusiasm, there desire to own and the actions from these consumers. Other factors that affect the demand of housing are the price of lot & house, its affordability, the availability

affect the demand of housing are the price of lot & house, its affordability, the availability of flexible financing options and household income, without these factors the lack of

of flexible financing options and household income, without these factors the lack of housing supply won’t fuel the demand among consumers. External forces such as war and

housing supply won’t fuel the demand among consumers. External forces such as war and natural calamities, also the expiration of the life-span of a housing unit contributes

natural calamities, also the expiration of the life-span of a housing unit contributes additional demand. Existing government bureaucratic efforts; its lending institutions,

additional demand. Existing government bureaucratic efforts; its lending institutions, financial intermediaries and guarantee entities were effective but inefficient, for it suffers

financial intermediaries and guarantee entities were effective but inefficient, for it suffers liquidity delays and rigid unnecessary documentation requirements that supposed to be an

liquidity delays and rigid unnecessary documentation requirements that supposed to be an inter-agency transaction that minimizes the cost and reduce processing time. Government

inter-agency transaction that minimizes the cost and reduce processing time. Government existing programs and the creation of (Housing and Urban Development Coordinating

existing programs and the creation of (Housing and Urban Development Coordinating Council (HUDCC) to administer the key housing agencies; National Housing Authority

Council (HUDCC) to administer the key housing agencies; National Housing Authority (NHA), National Home Mortgage and Finance Corporation (NHMFC), Home Development

(NHA), National Home Mortgage and Finance Corporation (NHMFC), Home Development Mutual Fund (HDMF), Housing and Land Use Regulatory Board (HLURB), and Home

Mutual Fund (HDMF), Housing and Land Use Regulatory Board (HLURB), and Home Guaranty Corporation (HGC) helps curb housing problems, situations does not confined

Guaranty Corporation (HGC) helps curb housing problems, situations does not confined only on providing affordable financing and household income transfer thru government

only on providing affordable financing and household income transfer thru government subsidiaries like Pag-Ibig Fund or, giving access to affordable housing and security of

subsidiaries like Pag-Ibig Fund or, giving access to affordable housing and security of tenure. Government should address the housing problem with the broader context. And

tenure. Government should address the housing problem with the broader context. And give emphasize on the demand side and

give emphasize on the demand side and especially the supply side of housing problems to

especially the supply side of housing problems to create the better framework.

create the better framework.  The 2015 research on The Philippines Housing

The 2015 research on The Philippines Housing reveals a huge gap in housing supply vs.

reveals a huge gap in housing supply vs. demand despite government efforts, private

demand despite government efforts, private partner’s enthusiasm, and foreign assistance on

partner’s enthusiasm, and foreign assistance on the housing programs, the seven digit housing

the housing programs, the seven digit housing disparity is still almost unchanged. Analyzing the

disparity is still almost unchanged. Analyzing the demand side of housing quandary, on the socio

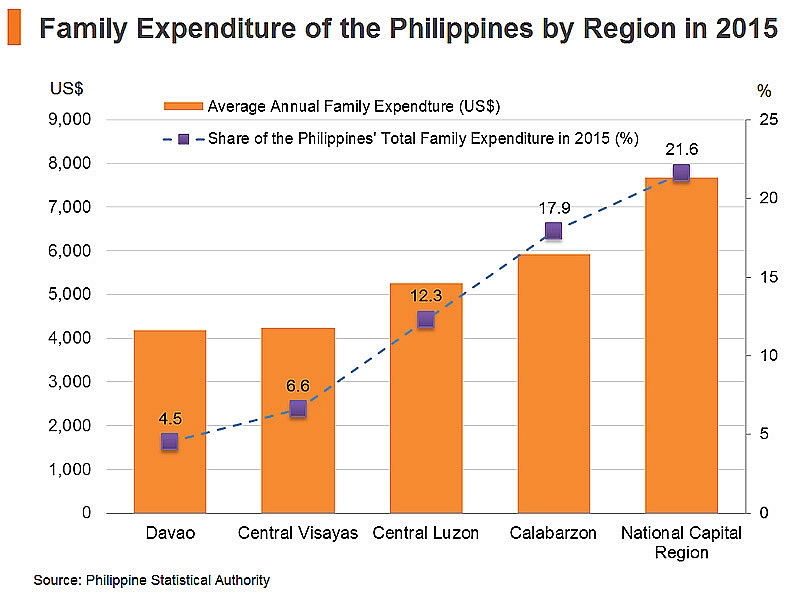

demand side of housing quandary, on the socio economic aspects; most household has a limited

economic aspects; most household has a limited source of income for their housing consumption. As of 2019 the ceiling price of a decent

source of income for their housing consumption. As of 2019 the ceiling price of a decent low cost house with 21 to 24 sqm is P480, 000, for a worker which has the daily wage of

low cost house with 21 to 24 sqm is P480, 000, for a worker which has the daily wage of P350 in the suburb provinces. The housing price is 380x (380%) of its yearly wages,

P350 in the suburb provinces. The housing price is 380x (380%) of its yearly wages, likewise for the socialized house costing P700, 000 is 555x or 555%. Considering the

likewise for the socialized house costing P700, 000 is 555x or 555%. Considering the ceiling price of an economic housing at 1.7 million, do the math will give 879x, or 87.9

ceiling price of an economic housing at 1.7 million, do the math will give 879x, or 87.9 percent of the annual income of a regular employee earning an income of P537/day or

percent of the annual income of a regular employee earning an income of P537/day or 161,100 per year, (a salary almost equal or a little greater than Ph GDP per Capita/ year),

161,100 per year, (a salary almost equal or a little greater than Ph GDP per Capita/ year), which financial analyst would view as unaffordable considering the average expenditures of

which financial analyst would view as unaffordable considering the average expenditures of a Filipino household is P267, 000 per year based on 2015 surveys. Comparing to Hong

a Filipino household is P267, 000 per year based on 2015 surveys. Comparing to Hong Kong and Singapore average house price to GDP per Capita of 65.59x and 25.96x

Kong and Singapore average house price to GDP per Capita of 65.59x and 25.96x respectively., (source: Global Property Guide) were the real estate markets were two of

respectively., (source: Global Property Guide) were the real estate markets were two of the most expensive in the world.

the most expensive in the world. The Philippine real estate is becoming a buying-spree for Filipinos working in other

The Philippine real estate is becoming a buying-spree for Filipinos working in other countries with the higher GDP/capita and savings, for foreigners with dual citizenship, for

countries with the higher GDP/capita and savings, for foreigners with dual citizenship, for expats with SRRV Visa, for foreign workers with

expats with SRRV Visa, for foreign workers with diplomatic errand like the Chinese and rich

diplomatic errand like the Chinese and rich Filipinos with dispensable income, owning

Filipinos with dispensable income, owning multiple properties and taking advantage of the

multiple properties and taking advantage of the undeveloped Philippine real estate rental

undeveloped Philippine real estate rental market. Transforming prime residential

market. Transforming prime residential condominiums of Metro Manila into empty

condominiums of Metro Manila into empty boxes. “The market has been characterized by

boxes. “The market has been characterized by record completions in supply, rising vacancy

record completions in supply, rising vacancy [rates] and declining yields, while capital values

[rates] and declining yields, while capital values for these properties have “plateaued” or

for these properties have “plateaued” or increased at a slower rate” Colliers International points out from its research in 2017.

increased at a slower rate” Colliers International points out from its research in 2017. Only a low-cost model house unit is the only most affordable shelter to own by an average

Only a low-cost model house unit is the only most affordable shelter to own by an average Filipino family without affecting the budget for the household basic needs and their

Filipino family without affecting the budget for the household basic needs and their standard of living. The house price to income ratio is expected to rise given the cost of

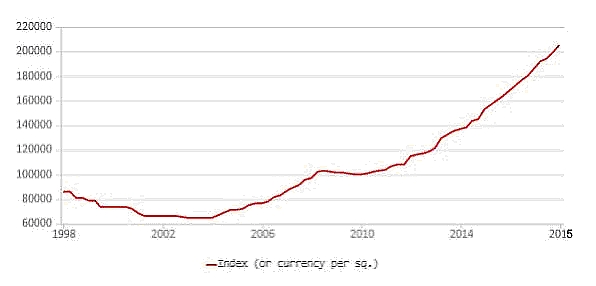

standard of living. The house price to income ratio is expected to rise given the cost of construction materials does not deviates much with the nations nominal inflation

construction materials does not deviates much with the nations nominal inflation fluctuations between 2% and 4% a year (2016

fluctuations between 2% and 4% a year (2016 to 2019) or by linear estimation using the

to 2019) or by linear estimation using the Philippine housing Index projection will result to

Philippine housing Index projection will result to  more or less 4% per annum.

more or less 4% per annum. A regular employee benefits and wages are flat

A regular employee benefits and wages are flat for the country’s wages is hardly regulated and

for the country’s wages is hardly regulated and couldn’t keep up for their housing needs that by

couldn’t keep up for their housing needs that by working overseas is the best option to belong to

working overseas is the best option to belong to a class of society that could afford such housing

a class of society that could afford such housing price. The class of buyer that belongs to the

price. The class of buyer that belongs to the higher middle class which at present represents the highest percentage of buyers of the

higher middle class which at present represents the highest percentage of buyers of the sales generated from real estate sales. The housing conditions in the country come at a

sales generated from real estate sales. The housing conditions in the country come at a price that a few middle income household can afford. Financing options presented by real

price that a few middle income household can afford. Financing options presented by real estate developers, private financing institution and Pag-Ibig aren’t much attractive since

estate developers, private financing institution and Pag-Ibig aren’t much attractive since the current levels of disposable income won’t allow the lower middle-income class to

the current levels of disposable income won’t allow the lower middle-income class to allocate some amount for housing for it will consequently lower their current standard of

allocate some amount for housing for it will consequently lower their current standard of living. Housing ownership hysteria is not only a subject matter for the under privilege,

living. Housing ownership hysteria is not only a subject matter for the under privilege, informal settler families and low income families but also for the middle class families

informal settler families and low income families but also for the middle class families because the Philippine average housing price

because the Philippine average housing price increase at 15% per year, condominium and

increase at 15% per year, condominium and high end housing prices in urban cities

high end housing prices in urban cities especially in Metro Manila increases 36% per

especially in Metro Manila increases 36% per year one of the highest in Asia based on the

year one of the highest in Asia based on the study of Habitat for Humanity and World

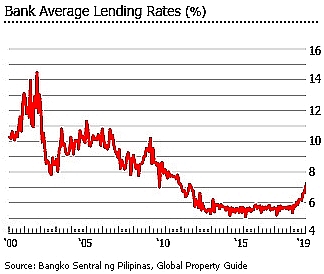

study of Habitat for Humanity and World Bank. Thanks to BSP for regulating country’s

Bank. Thanks to BSP for regulating country’s financing institutions by maintaining the

financing institutions by maintaining the economy buoyant, lowering interest rates;

economy buoyant, lowering interest rates; maintaining affordability level of real estate

maintaining affordability level of real estate for middle earner consumers.

for middle earner consumers.  The speculative projected growth of real estate prices by economic managers cause by

The speculative projected growth of real estate prices by economic managers cause by housing demand continues to escalate even though it doest cater its desired market. This

housing demand continues to escalate even though it doest cater its desired market. This makes Philippine real estate especially high-end housing in a bubble, but sustainable. Its

makes Philippine real estate especially high-end housing in a bubble, but sustainable. Its ability to remain buoyant benefits the real estate builders, land owners and developers.

ability to remain buoyant benefits the real estate builders, land owners and developers. Thus, housing is more a business for financial gain and less philanthropy works for

Thus, housing is more a business for financial gain and less philanthropy works for government’s private partners. That, for a Filipino family’s dream of owning a house is a

government’s private partners. That, for a Filipino family’s dream of owning a house is a race for its affordability. Middle income families or the working class finds it difficult to own

race for its affordability. Middle income families or the working class finds it difficult to own a dwelling unit within the comfort distance from their working places because of the

a dwelling unit within the comfort distance from their working places because of the shortage on the availability of land for residential, housing development in highly urban

shortage on the availability of land for residential, housing development in highly urban areas and high cost of land. The case reflects the demand side of housing dilemma. The

areas and high cost of land. The case reflects the demand side of housing dilemma. The soaring rate increase in land prices is a major factor in house price appreciation.

soaring rate increase in land prices is a major factor in house price appreciation. (Strassman and Blunt 1993; Ballesteros

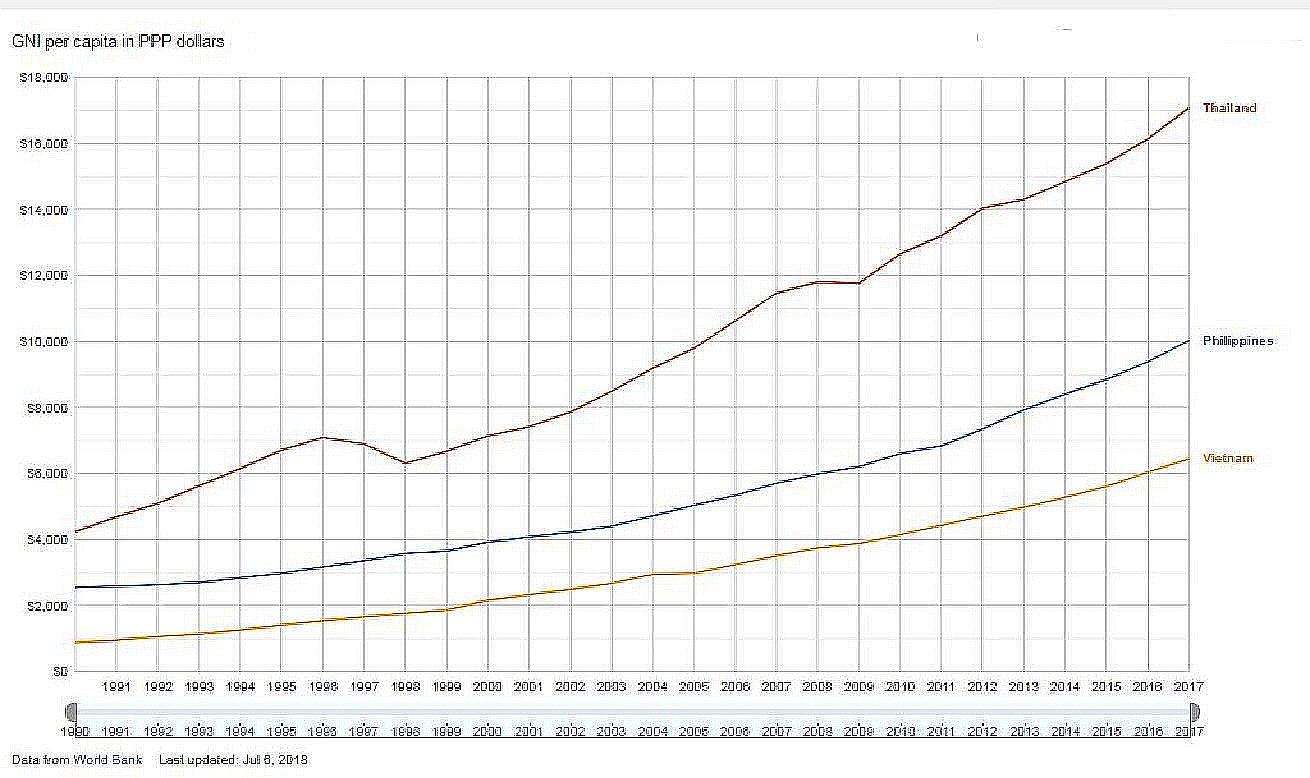

(Strassman and Blunt 1993; Ballesteros 2000; Grimes 1976). International rule

2000; Grimes 1976). International rule housing for a low income family of 100 sqm

housing for a low income family of 100 sqm lots should cost a little more or less as GNI

lots should cost a little more or less as GNI per capita of a country. In the case of the

per capita of a country. In the case of the lands outside Metro Manila like in Bacolod

lands outside Metro Manila like in Bacolod City where the raw land along outstretch of

City where the raw land along outstretch of the urban centers is more or less the prices

the urban centers is more or less the prices reaches 1000/sqm. Doing the math results

reaches 1000/sqm. Doing the math results to 0.20 times of the country GNI per capita

to 0.20 times of the country GNI per capita (Ph GNI/capita $10,000, 2017), somewhat

(Ph GNI/capita $10,000, 2017), somewhat feasible but when subdivided and developed

feasible but when subdivided and developed it further raised 5.3 to 6.7 its original value. Say at present for example (Bacolod City) a

it further raised 5.3 to 6.7 its original value. Say at present for example (Bacolod City) a suburb lot in a developed subdivision with the area of 100 sqm price now at 5000/sqm.

suburb lot in a developed subdivision with the area of 100 sqm price now at 5000/sqm. Price/ (GNI/capita) = 1.0 x GNI, which prove accurate. Acquisition of agricultural land is

Price/ (GNI/capita) = 1.0 x GNI, which prove accurate. Acquisition of agricultural land is somewhat a longer process because of the conflicting procedures among government

somewhat a longer process because of the conflicting procedures among government agencies and the government’s lacks of centralized regional processing centers, the prices

agencies and the government’s lacks of centralized regional processing centers, the prices rises further to 2.5 to 3 times once converted and zoned for urban use. (Studied by World

rises further to 2.5 to 3 times once converted and zoned for urban use. (Studied by World Bank and UNCHS). However analysis centers on the average class or middle class as a

Bank and UNCHS). However analysis centers on the average class or middle class as a whole, for the parameters used are base on middle values or the average values specified

whole, for the parameters used are base on middle values or the average values specified in the economic indicators; GDP, GNI. The classes below middle will suffer most by the

in the economic indicators; GDP, GNI. The classes below middle will suffer most by the escalating value of land and houses, since analysis shows the middle class is already within

escalating value of land and houses, since analysis shows the middle class is already within the threshold and existing housing projects does not cater the prevailing market that is the

the threshold and existing housing projects does not cater the prevailing market that is the Middle income class. The risk on housing program not to realize exist till the Philippine

Middle income class. The risk on housing program not to realize exist till the Philippine ambition to become middle class society is realize thru wealth accumulation and

ambition to become middle class society is realize thru wealth accumulation and distribution by enactment of policies programs and constant monitor of the country’s

distribution by enactment of policies programs and constant monitor of the country’s progress in achieving development goals.

progress in achieving development goals. Problems of the housing shortage is the

Problems of the housing shortage is the availability of land for housing cause by

availability of land for housing cause by lack of allocation for residential and

lack of allocation for residential and urban development, the system of

urban development, the system of permitting procedure and conflicting of

permitting procedure and conflicting of interest among government agencies.

interest among government agencies.  Think Tank Center for Housing and

Think Tank Center for Housing and Independent Research Synergies in a

Independent Research Synergies in a research study housing developers

research study housing developers currently have to go through 27 offices

currently have to go through 27 offices to secure 78 permits and 146

to secure 78 permits and 146 signatures, for a total of 373

signatures, for a total of 373 documents. Agencies such as the local government unit, the Department of Agriculture,

documents. Agencies such as the local government unit, the Department of Agriculture, Department of Agrarian Reform, Department of Environment and Natural Resources,

Department of Agrarian Reform, Department of Environment and Natural Resources, Bureau of Internal Revenue, and Housing and Land Use Regulatory Board (HLURB), among

Bureau of Internal Revenue, and Housing and Land Use Regulatory Board (HLURB), among others. The creation of Department of Human Settlement and Urban Development

others. The creation of Department of Human Settlement and Urban Development (DHSUD) involves a paradigm shift in the approach to public housing as a solution to the

(DHSUD) involves a paradigm shift in the approach to public housing as a solution to the housing backlog. It would introduce housing in government lands suitable for development

housing backlog. It would introduce housing in government lands suitable for development and construction of medium-and high-rise buildings using centrally located government

and construction of medium-and high-rise buildings using centrally located government lands, so beneficiaries in the inner city would be better served. Singapore is the best model

lands, so beneficiaries in the inner city would be better served. Singapore is the best model for this, and the government be certain on its mission; exert effort and allocate the bigger

for this, and the government be certain on its mission; exert effort and allocate the bigger pie for housing program from the 0.07 percent of 2019 National Budget.

pie for housing program from the 0.07 percent of 2019 National Budget. The Government’s programs on Housing was still in the transition for the implementation

The Government’s programs on Housing was still in the transition for the implementation of its new policies, rules and regulations from the enactment of Republic Act 11201. The

of its new policies, rules and regulations from the enactment of Republic Act 11201. The outcome is yet to be determine in a few years.

outcome is yet to be determine in a few years.

has reached an astonishing 1.3 Million, alarms has been detected before by housing

has reached an astonishing 1.3 Million, alarms has been detected before by housing organizations and real estate experts subsequent supply starts to decline from 220,756 to

organizations and real estate experts subsequent supply starts to decline from 220,756 to 200,124 units constructed based in 2009 record of HLURB Licensed to sell (LTS) database,

200,124 units constructed based in 2009 record of HLURB Licensed to sell (LTS) database, figures that hasn’t given much importance at the time for banks implements tights

figures that hasn’t given much importance at the time for banks implements tights borrowing policies and real estate developers just want to loosen up the real estate market

borrowing policies and real estate developers just want to loosen up the real estate market from over heating and most companies recuperates from the effect of world wide economic

from over heating and most companies recuperates from the effect of world wide economic crisis that brought down investments in chaos, The aftermath of the collapse of sub-prime

crisis that brought down investments in chaos, The aftermath of the collapse of sub-prime mortgage crisis known as the “housing bubble” in the US in 2008 affects economies world

mortgage crisis known as the “housing bubble” in the US in 2008 affects economies world wide, the slump that brought by the Financial Crisis alters the perceptions on the stability

wide, the slump that brought by the Financial Crisis alters the perceptions on the stability of real estate market as a secured investment. Meanwhile in the Philippines, the supply of

of real estate market as a secured investment. Meanwhile in the Philippines, the supply of affordable homes in the country hasn’t keeping up with the demand since then, creating a

affordable homes in the country hasn’t keeping up with the demand since then, creating a vacuum for real estate market to breath and that trigger a renewed demand that benefit

vacuum for real estate market to breath and that trigger a renewed demand that benefit the Philippines Real Estate going to its 9th successive year growth according to Global

the Philippines Real Estate going to its 9th successive year growth according to Global Property Guide. Recent industry report; “Impact of Housing Activities on the Philippine

Property Guide. Recent industry report; “Impact of Housing Activities on the Philippine Economy" jointly completed by the Center for

Economy" jointly completed by the Center for Research and Communication of the University of

Research and Communication of the University of Asia and the Pacific (CRC-UAP) and Subdivision

Asia and the Pacific (CRC-UAP) and Subdivision and Housing Developers Association (SHDA), the

and Housing Developers Association (SHDA), the backlog have reached at 6.7 million in 2015, plus

backlog have reached at 6.7 million in 2015, plus with the new housing need for the growing

with the new housing need for the growing Philippine population rate of 1.84% per annum

Philippine population rate of 1.84% per annum (2000-2015 PH growth rate) and with a

(2000-2015 PH growth rate) and with a household size of 4.4 (Philippine Statistics

household size of 4.4 (Philippine Statistics Authority), approximately the additional demand

Authority), approximately the additional demand for the period 2016 to 2030 will reached 7.27

for the period 2016 to 2030 will reached 7.27 Million. HLURB record on housing production rate is unstable with the drop of 25.57% from

Million. HLURB record on housing production rate is unstable with the drop of 25.57% from 274,545 in 2017 to 204,344 units in 2018. With the production rate between; 200,000 to

274,545 in 2017 to 204,344 units in 2018. With the production rate between; 200,000 to 250,000 per year will only results to an accumulated production of 3.15 million in 15 years

250,000 per year will only results to an accumulated production of 3.15 million in 15 years and the Philippine Statistics Authority only shows 20 thousand to 30 thousand every

and the Philippine Statistics Authority only shows 20 thousand to 30 thousand every quarter year of building permit applications for residential construction assuming 100%

quarter year of building permit applications for residential construction assuming 100% occupancy rate and for 15 years getting the average would add up to only 1.5 Million.

occupancy rate and for 15 years getting the average would add up to only 1.5 Million. Without much more effort from the Philippine government and intervention from private

Without much more effort from the Philippine government and intervention from private sectors and institutions. The country would still needs a total of 9.32 million houses to

sectors and institutions. The country would still needs a total of 9.32 million houses to break-even, meeting 10 years earlier Philippine goal “Ambition Natin 2040” - decent house

break-even, meeting 10 years earlier Philippine goal “Ambition Natin 2040” - decent house for every Filipino household”

for every Filipino household” Basically, demand in housing is based on the household’s security of tenure and mostly on

Basically, demand in housing is based on the household’s security of tenure and mostly on how a growing family adjusts into their housing consumption given that places them in

how a growing family adjusts into their housing consumption given that places them in equilibrium, if the equilibrium has not meet; modification of existing units, relocating to a

equilibrium, if the equilibrium has not meet; modification of existing units, relocating to a bigger or adding another unit become an option to meet satisfaction and comfort for the

bigger or adding another unit become an option to meet satisfaction and comfort for the certain household,. As the trends continue the demand on housing rises but requires

certain household,. As the trends continue the demand on housing rises but requires enthusiasm, there desire to own and the actions from these consumers. Other factors that

enthusiasm, there desire to own and the actions from these consumers. Other factors that affect the demand of housing are the price of lot & house, its affordability, the availability

affect the demand of housing are the price of lot & house, its affordability, the availability of flexible financing options and household income, without these factors the lack of

of flexible financing options and household income, without these factors the lack of housing supply won’t fuel the demand among consumers. External forces such as war and

housing supply won’t fuel the demand among consumers. External forces such as war and natural calamities, also the expiration of the life-span of a housing unit contributes

natural calamities, also the expiration of the life-span of a housing unit contributes additional demand. Existing government bureaucratic efforts; its lending institutions,

additional demand. Existing government bureaucratic efforts; its lending institutions, financial intermediaries and guarantee entities were effective but inefficient, for it suffers

financial intermediaries and guarantee entities were effective but inefficient, for it suffers liquidity delays and rigid unnecessary documentation requirements that supposed to be an

liquidity delays and rigid unnecessary documentation requirements that supposed to be an inter-agency transaction that minimizes the cost and reduce processing time. Government

inter-agency transaction that minimizes the cost and reduce processing time. Government existing programs and the creation of (Housing and Urban Development Coordinating

existing programs and the creation of (Housing and Urban Development Coordinating Council (HUDCC) to administer the key housing agencies; National Housing Authority

Council (HUDCC) to administer the key housing agencies; National Housing Authority (NHA), National Home Mortgage and Finance Corporation (NHMFC), Home Development

(NHA), National Home Mortgage and Finance Corporation (NHMFC), Home Development Mutual Fund (HDMF), Housing and Land Use Regulatory Board (HLURB), and Home

Mutual Fund (HDMF), Housing and Land Use Regulatory Board (HLURB), and Home Guaranty Corporation (HGC) helps curb housing problems, situations does not confined

Guaranty Corporation (HGC) helps curb housing problems, situations does not confined only on providing affordable financing and household income transfer thru government

only on providing affordable financing and household income transfer thru government subsidiaries like Pag-Ibig Fund or, giving access to affordable housing and security of

subsidiaries like Pag-Ibig Fund or, giving access to affordable housing and security of tenure. Government should address the housing problem with the broader context. And

tenure. Government should address the housing problem with the broader context. And give emphasize on the demand side and

give emphasize on the demand side and especially the supply side of housing problems to

especially the supply side of housing problems to create the better framework.

create the better framework.  The 2015 research on The Philippines Housing

The 2015 research on The Philippines Housing reveals a huge gap in housing supply vs.

reveals a huge gap in housing supply vs. demand despite government efforts, private

demand despite government efforts, private partner’s enthusiasm, and foreign assistance on

partner’s enthusiasm, and foreign assistance on the housing programs, the seven digit housing

the housing programs, the seven digit housing disparity is still almost unchanged. Analyzing the

disparity is still almost unchanged. Analyzing the demand side of housing quandary, on the socio

demand side of housing quandary, on the socio economic aspects; most household has a limited

economic aspects; most household has a limited source of income for their housing consumption. As of 2019 the ceiling price of a decent

source of income for their housing consumption. As of 2019 the ceiling price of a decent low cost house with 21 to 24 sqm is P480, 000, for a worker which has the daily wage of

low cost house with 21 to 24 sqm is P480, 000, for a worker which has the daily wage of P350 in the suburb provinces. The housing price is 380x (380%) of its yearly wages,

P350 in the suburb provinces. The housing price is 380x (380%) of its yearly wages, likewise for the socialized house costing P700, 000 is 555x or 555%. Considering the

likewise for the socialized house costing P700, 000 is 555x or 555%. Considering the ceiling price of an economic housing at 1.7 million, do the math will give 879x, or 87.9

ceiling price of an economic housing at 1.7 million, do the math will give 879x, or 87.9 percent of the annual income of a regular employee earning an income of P537/day or

percent of the annual income of a regular employee earning an income of P537/day or 161,100 per year, (a salary almost equal or a little greater than Ph GDP per Capita/ year),

161,100 per year, (a salary almost equal or a little greater than Ph GDP per Capita/ year), which financial analyst would view as unaffordable considering the average expenditures of

which financial analyst would view as unaffordable considering the average expenditures of a Filipino household is P267, 000 per year based on 2015 surveys. Comparing to Hong

a Filipino household is P267, 000 per year based on 2015 surveys. Comparing to Hong Kong and Singapore average house price to GDP per Capita of 65.59x and 25.96x

Kong and Singapore average house price to GDP per Capita of 65.59x and 25.96x respectively., (source: Global Property Guide) were the real estate markets were two of

respectively., (source: Global Property Guide) were the real estate markets were two of the most expensive in the world.

the most expensive in the world. The Philippine real estate is becoming a buying-spree for Filipinos working in other

The Philippine real estate is becoming a buying-spree for Filipinos working in other countries with the higher GDP/capita and savings, for foreigners with dual citizenship, for

countries with the higher GDP/capita and savings, for foreigners with dual citizenship, for expats with SRRV Visa, for foreign workers with

expats with SRRV Visa, for foreign workers with diplomatic errand like the Chinese and rich

diplomatic errand like the Chinese and rich Filipinos with dispensable income, owning

Filipinos with dispensable income, owning multiple properties and taking advantage of the

multiple properties and taking advantage of the undeveloped Philippine real estate rental

undeveloped Philippine real estate rental market. Transforming prime residential

market. Transforming prime residential condominiums of Metro Manila into empty

condominiums of Metro Manila into empty boxes. “The market has been characterized by

boxes. “The market has been characterized by record completions in supply, rising vacancy

record completions in supply, rising vacancy [rates] and declining yields, while capital values

[rates] and declining yields, while capital values for these properties have “plateaued” or

for these properties have “plateaued” or increased at a slower rate” Colliers International points out from its research in 2017.

increased at a slower rate” Colliers International points out from its research in 2017. Only a low-cost model house unit is the only most affordable shelter to own by an average

Only a low-cost model house unit is the only most affordable shelter to own by an average Filipino family without affecting the budget for the household basic needs and their

Filipino family without affecting the budget for the household basic needs and their standard of living. The house price to income ratio is expected to rise given the cost of

standard of living. The house price to income ratio is expected to rise given the cost of construction materials does not deviates much with the nations nominal inflation

construction materials does not deviates much with the nations nominal inflation fluctuations between 2% and 4% a year (2016

fluctuations between 2% and 4% a year (2016 to 2019) or by linear estimation using the

to 2019) or by linear estimation using the Philippine housing Index projection will result to

Philippine housing Index projection will result to  more or less 4% per annum.

more or less 4% per annum. A regular employee benefits and wages are flat

A regular employee benefits and wages are flat for the country’s wages is hardly regulated and

for the country’s wages is hardly regulated and couldn’t keep up for their housing needs that by

couldn’t keep up for their housing needs that by working overseas is the best option to belong to

working overseas is the best option to belong to a class of society that could afford such housing

a class of society that could afford such housing price. The class of buyer that belongs to the

price. The class of buyer that belongs to the higher middle class which at present represents the highest percentage of buyers of the

higher middle class which at present represents the highest percentage of buyers of the sales generated from real estate sales. The housing conditions in the country come at a

sales generated from real estate sales. The housing conditions in the country come at a price that a few middle income household can afford. Financing options presented by real

price that a few middle income household can afford. Financing options presented by real estate developers, private financing institution and Pag-Ibig aren’t much attractive since

estate developers, private financing institution and Pag-Ibig aren’t much attractive since the current levels of disposable income won’t allow the lower middle-income class to

the current levels of disposable income won’t allow the lower middle-income class to allocate some amount for housing for it will consequently lower their current standard of

allocate some amount for housing for it will consequently lower their current standard of living. Housing ownership hysteria is not only a subject matter for the under privilege,

living. Housing ownership hysteria is not only a subject matter for the under privilege, informal settler families and low income families but also for the middle class families

informal settler families and low income families but also for the middle class families because the Philippine average housing price

because the Philippine average housing price increase at 15% per year, condominium and

increase at 15% per year, condominium and high end housing prices in urban cities

high end housing prices in urban cities especially in Metro Manila increases 36% per

especially in Metro Manila increases 36% per year one of the highest in Asia based on the

year one of the highest in Asia based on the study of Habitat for Humanity and World

study of Habitat for Humanity and World Bank. Thanks to BSP for regulating country’s

Bank. Thanks to BSP for regulating country’s financing institutions by maintaining the

financing institutions by maintaining the economy buoyant, lowering interest rates;

economy buoyant, lowering interest rates; maintaining affordability level of real estate

maintaining affordability level of real estate for middle earner consumers.

for middle earner consumers.  The speculative projected growth of real estate prices by economic managers cause by

The speculative projected growth of real estate prices by economic managers cause by housing demand continues to escalate even though it doest cater its desired market. This

housing demand continues to escalate even though it doest cater its desired market. This makes Philippine real estate especially high-end housing in a bubble, but sustainable. Its

makes Philippine real estate especially high-end housing in a bubble, but sustainable. Its ability to remain buoyant benefits the real estate builders, land owners and developers.

ability to remain buoyant benefits the real estate builders, land owners and developers. Thus, housing is more a business for financial gain and less philanthropy works for

Thus, housing is more a business for financial gain and less philanthropy works for government’s private partners. That, for a Filipino family’s dream of owning a house is a

government’s private partners. That, for a Filipino family’s dream of owning a house is a race for its affordability. Middle income families or the working class finds it difficult to own

race for its affordability. Middle income families or the working class finds it difficult to own a dwelling unit within the comfort distance from their working places because of the

a dwelling unit within the comfort distance from their working places because of the shortage on the availability of land for residential, housing development in highly urban

shortage on the availability of land for residential, housing development in highly urban areas and high cost of land. The case reflects the demand side of housing dilemma. The

areas and high cost of land. The case reflects the demand side of housing dilemma. The soaring rate increase in land prices is a major factor in house price appreciation.

soaring rate increase in land prices is a major factor in house price appreciation. (Strassman and Blunt 1993; Ballesteros

(Strassman and Blunt 1993; Ballesteros 2000; Grimes 1976). International rule

2000; Grimes 1976). International rule housing for a low income family of 100 sqm

housing for a low income family of 100 sqm lots should cost a little more or less as GNI

lots should cost a little more or less as GNI per capita of a country. In the case of the

per capita of a country. In the case of the lands outside Metro Manila like in Bacolod

lands outside Metro Manila like in Bacolod City where the raw land along outstretch of

City where the raw land along outstretch of the urban centers is more or less the prices

the urban centers is more or less the prices reaches 1000/sqm. Doing the math results

reaches 1000/sqm. Doing the math results to 0.20 times of the country GNI per capita

to 0.20 times of the country GNI per capita (Ph GNI/capita $10,000, 2017), somewhat

(Ph GNI/capita $10,000, 2017), somewhat feasible but when subdivided and developed

feasible but when subdivided and developed it further raised 5.3 to 6.7 its original value. Say at present for example (Bacolod City) a

it further raised 5.3 to 6.7 its original value. Say at present for example (Bacolod City) a suburb lot in a developed subdivision with the area of 100 sqm price now at 5000/sqm.

suburb lot in a developed subdivision with the area of 100 sqm price now at 5000/sqm. Price/ (GNI/capita) = 1.0 x GNI, which prove accurate. Acquisition of agricultural land is

Price/ (GNI/capita) = 1.0 x GNI, which prove accurate. Acquisition of agricultural land is somewhat a longer process because of the conflicting procedures among government

somewhat a longer process because of the conflicting procedures among government agencies and the government’s lacks of centralized regional processing centers, the prices

agencies and the government’s lacks of centralized regional processing centers, the prices rises further to 2.5 to 3 times once converted and zoned for urban use. (Studied by World

rises further to 2.5 to 3 times once converted and zoned for urban use. (Studied by World Bank and UNCHS). However analysis centers on the average class or middle class as a

Bank and UNCHS). However analysis centers on the average class or middle class as a whole, for the parameters used are base on middle values or the average values specified

whole, for the parameters used are base on middle values or the average values specified in the economic indicators; GDP, GNI. The classes below middle will suffer most by the

in the economic indicators; GDP, GNI. The classes below middle will suffer most by the escalating value of land and houses, since analysis shows the middle class is already within

escalating value of land and houses, since analysis shows the middle class is already within the threshold and existing housing projects does not cater the prevailing market that is the

the threshold and existing housing projects does not cater the prevailing market that is the Middle income class. The risk on housing program not to realize exist till the Philippine

Middle income class. The risk on housing program not to realize exist till the Philippine ambition to become middle class society is realize thru wealth accumulation and

ambition to become middle class society is realize thru wealth accumulation and distribution by enactment of policies programs and constant monitor of the country’s

distribution by enactment of policies programs and constant monitor of the country’s progress in achieving development goals.

progress in achieving development goals. Problems of the housing shortage is the

Problems of the housing shortage is the availability of land for housing cause by

availability of land for housing cause by lack of allocation for residential and

lack of allocation for residential and urban development, the system of

urban development, the system of permitting procedure and conflicting of

permitting procedure and conflicting of interest among government agencies.

interest among government agencies.  Think Tank Center for Housing and

Think Tank Center for Housing and Independent Research Synergies in a

Independent Research Synergies in a research study housing developers

research study housing developers currently have to go through 27 offices

currently have to go through 27 offices to secure 78 permits and 146

to secure 78 permits and 146 signatures, for a total of 373

signatures, for a total of 373 documents. Agencies such as the local government unit, the Department of Agriculture,

documents. Agencies such as the local government unit, the Department of Agriculture, Department of Agrarian Reform, Department of Environment and Natural Resources,

Department of Agrarian Reform, Department of Environment and Natural Resources, Bureau of Internal Revenue, and Housing and Land Use Regulatory Board (HLURB), among

Bureau of Internal Revenue, and Housing and Land Use Regulatory Board (HLURB), among others. The creation of Department of Human Settlement and Urban Development

others. The creation of Department of Human Settlement and Urban Development (DHSUD) involves a paradigm shift in the approach to public housing as a solution to the

(DHSUD) involves a paradigm shift in the approach to public housing as a solution to the housing backlog. It would introduce housing in government lands suitable for development

housing backlog. It would introduce housing in government lands suitable for development and construction of medium-and high-rise buildings using centrally located government

and construction of medium-and high-rise buildings using centrally located government lands, so beneficiaries in the inner city would be better served. Singapore is the best model

lands, so beneficiaries in the inner city would be better served. Singapore is the best model for this, and the government be certain on its mission; exert effort and allocate the bigger

for this, and the government be certain on its mission; exert effort and allocate the bigger pie for housing program from the 0.07 percent of 2019 National Budget.

pie for housing program from the 0.07 percent of 2019 National Budget. The Government’s programs on Housing was still in the transition for the implementation

The Government’s programs on Housing was still in the transition for the implementation of its new policies, rules and regulations from the enactment of Republic Act 11201. The

of its new policies, rules and regulations from the enactment of Republic Act 11201. The outcome is yet to be determine in a few years.

outcome is yet to be determine in a few years.

Leave a Response

Analyzing Philippine Housing Gap, What our government have missed?

Your Real Estate Consultant

Questions? Call us![]() :

+639292728351 /

+639776975030

(Viber)

:

+639292728351 /

+639776975030

(Viber)

by: Eugene Catalan

Posted: August 2019

by: Eugene Catalan

Posted: August 2019