Bacolod City News

and the World

Bacolod Real Estate Blog

Bacolod real estate news, blogs, articles

and investment advices

The Philippine Economic Position prior to COVID19 Pandemic

Once the corona viruses pandemic is mitigated, the new normal shall be marked by slow growth, most will be assessing and restructuring their financial standings, repayment of

growth, most will be assessing and restructuring their financial standings, repayment of financial obligations and liquidity shall be every ones priority. Banks and financial

financial obligations and liquidity shall be every ones priority. Banks and financial institutions flooded by loans and real estate mortgages were expected thereafter.

institutions flooded by loans and real estate mortgages were expected thereafter. Furthermore, health security consciousness, risk of deflation and/or inflation of

Furthermore, health security consciousness, risk of deflation and/or inflation of commodities, the distrust of equities and investments were likely to happen and

commodities, the distrust of equities and investments were likely to happen and ingratiated the slow growth. After taking the initial beating from the COVID19 pandemic

ingratiated the slow growth. After taking the initial beating from the COVID19 pandemic that transmuted into health crisis; restricted social mobility and economic fallouts from

that transmuted into health crisis; restricted social mobility and economic fallouts from imposed mitigations.

imposed mitigations.  The Philippine economy suffers from

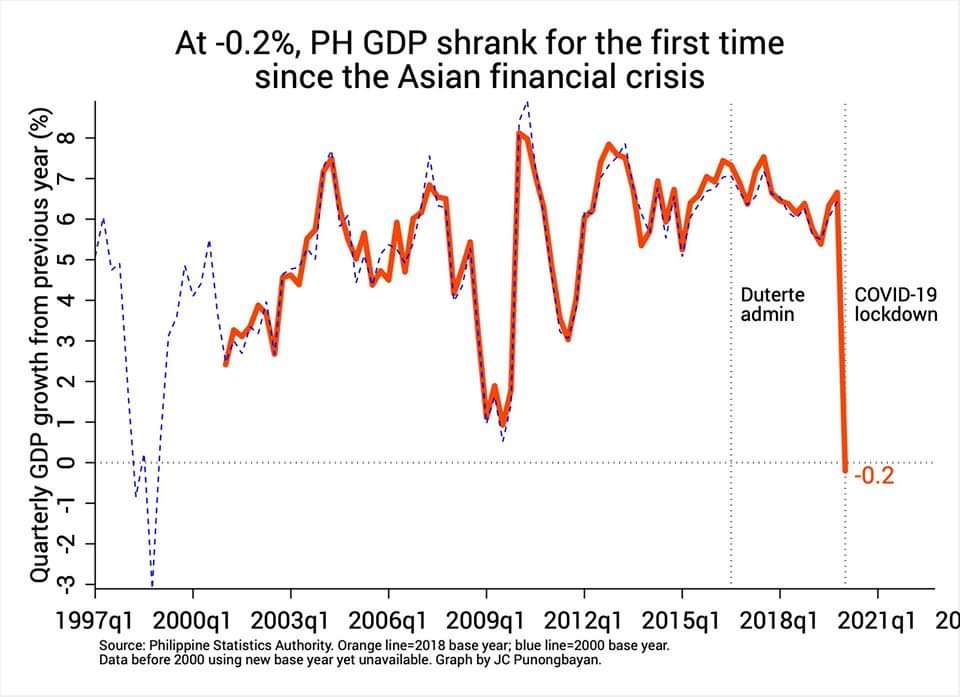

The Philippine economy suffers from financial a shock that shrinks its GDP

financial a shock that shrinks its GDP by 0.2% in the first quarter of 2020.

by 0.2% in the first quarter of 2020. The highest contraction in more than

The highest contraction in more than two decades, surpassing two

two decades, surpassing two economic crises; Asian Financial crisis

economic crises; Asian Financial crisis 1998 and 2008 collapsed of derivative

1998 and 2008 collapsed of derivative CDO (collateralize debt obligation)

CDO (collateralize debt obligation) also known as the Sub-prime

also known as the Sub-prime Mortgage collapsed that triggered the

Mortgage collapsed that triggered the global financial crisis. Subsequently,

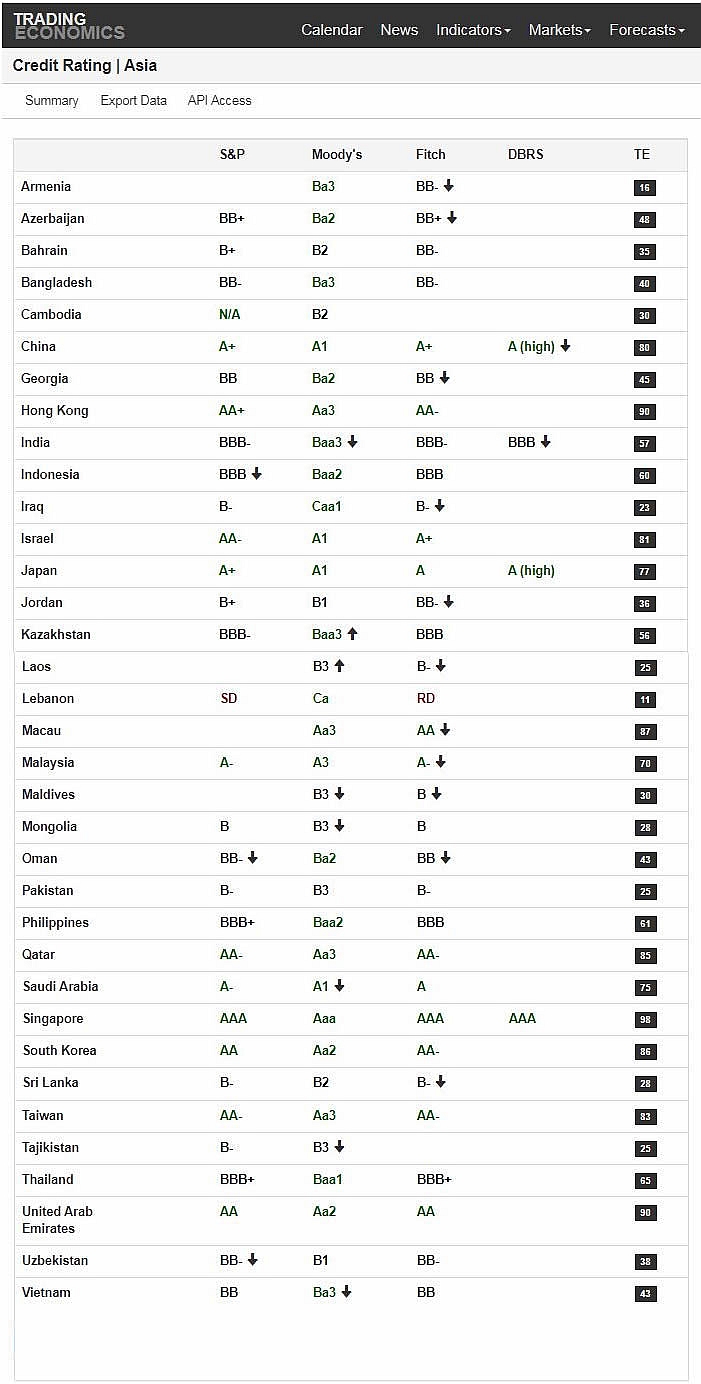

global financial crisis. Subsequently, the New York based Fitch rating

the New York based Fitch rating lowered the Philippine credit rating

lowered the Philippine credit rating from investment grade (BBB+) to

from investment grade (BBB+) to stable (BBB). Initially during Pre-

stable (BBB). Initially during Pre- pandemic the International Monetary

pandemic the International Monetary Fund had a high hopes for the

Fund had a high hopes for the Philippine economy to reach 6.3%,

Philippine economy to reach 6.3%, but may enough be lucky to have the

but may enough be lucky to have the upper bound projection of 2% (ADB), as the pandemic looms, since the ASEAN 5 average

upper bound projection of 2% (ADB), as the pandemic looms, since the ASEAN 5 average GDP projection was only -0.6% by IMF. Fitch states the downgrade reflects the

GDP projection was only -0.6% by IMF. Fitch states the downgrade reflects the deterioration in the country short term macro economic and fiscal outlook as result of

deterioration in the country short term macro economic and fiscal outlook as result of country's pandemic mitigations. But, does the Philippines prepared for the subsequent long

country's pandemic mitigations. But, does the Philippines prepared for the subsequent long term impact of COVID19 in the Real estate Industry and economy?

term impact of COVID19 in the Real estate Industry and economy?  Bangko Sentral ng Pilipinas Governor Benhamin Diokno said "Structural reforms and sound

Bangko Sentral ng Pilipinas Governor Benhamin Diokno said "Structural reforms and sound economic management over the years have provided us with monetary and fiscal space to

economic management over the years have provided us with monetary and fiscal space to safeguard lives and support livelihoods at this critical time". The last decade was slow but

safeguard lives and support livelihoods at this critical time". The last decade was slow but steady and interrupted economic growth in the Philippines, with controlled inflation and

steady and interrupted economic growth in the Philippines, with controlled inflation and rising employment. The economic progress was supported visually by the distinctive

rising employment. The economic progress was supported visually by the distinctive attribution to the Metropolitans Skylines. Fundamentally, the Philippine real estate market,

attribution to the Metropolitans Skylines. Fundamentally, the Philippine real estate market, was at the end of economic cycle before the pandemic devastates the economy and is due

was at the end of economic cycle before the pandemic devastates the economy and is due for a healthy corrections in-symmetry with its regional neighbours. These are our insights

for a healthy corrections in-symmetry with its regional neighbours. These are our insights at the start of the period of New Business period in 2020, when the clock starts while the

at the start of the period of New Business period in 2020, when the clock starts while the country is building resilience to adapt the new normal in the midst of the pandemic.

country is building resilience to adapt the new normal in the midst of the pandemic. Real Estate, Financial market and Industries Implications from COVID19

The Real estate Industry before the start of the 1st quarter 2020 is marked by strong

Real Estate, Financial market and Industries Implications from COVID19

The Real estate Industry before the start of the 1st quarter 2020 is marked by strong growth for most segments, supported by gradual increase of supply and strong demand

growth for most segments, supported by gradual increase of supply and strong demand (as indicated in by the Real Estate price index),but are at peril from contraction or slow

(as indicated in by the Real Estate price index),but are at peril from contraction or slow growth in the coming months; demands are expected to plunges in short term but would

growth in the coming months; demands are expected to plunges in short term but would bounce and would steadily increase in the long run, the prices will stabilize more or less at

bounce and would steadily increase in the long run, the prices will stabilize more or less at its current value. Rental units vacancy were expected to rise and vacancy rates are

its current value. Rental units vacancy were expected to rise and vacancy rates are anticipated to stabilize or discounted in a short term till the last quarter except for

anticipated to stabilize or discounted in a short term till the last quarter except for residential in urban vicinities., As

residential in urban vicinities., As mentioned earlier the liquidity is

mentioned earlier the liquidity is a prime objectives after

a prime objectives after community quarantine most

community quarantine most individuals and businesses

individuals and businesses strained from financial stress

strained from financial stress shall dispose the more saleable,

shall dispose the more saleable, tangible, none performing assets

tangible, none performing assets and secondary properties that are

and secondary properties that are viable for disposition. And thence,

viable for disposition. And thence, post-GCQ is the best time to

post-GCQ is the best time to acquire land and distress

acquire land and distress properties for real property

properties for real property bankers and investors.

At the restart of the economy, most of the industries from small to large enterprises will

bankers and investors.

At the restart of the economy, most of the industries from small to large enterprises will start to re-evaluate their financial standings. New loans and mortgages will overwhelm

start to re-evaluate their financial standings. New loans and mortgages will overwhelm banks, financial restructuring, and merging, corporate downsizing and buy outs were likely

banks, financial restructuring, and merging, corporate downsizing and buy outs were likely depending on the duration of the pandemic and its aftermaths. And the effect on

depending on the duration of the pandemic and its aftermaths. And the effect on employment won't be spared. These valuable insights show how the markets behave from

employment won't be spared. These valuable insights show how the markets behave from the after-effect of the past financial crises. However, the severity of the present crisis will

the after-effect of the past financial crises. However, the severity of the present crisis will determine on the magnitude of damage, the longevity and government counter measures

determine on the magnitude of damage, the longevity and government counter measures until it is contained.

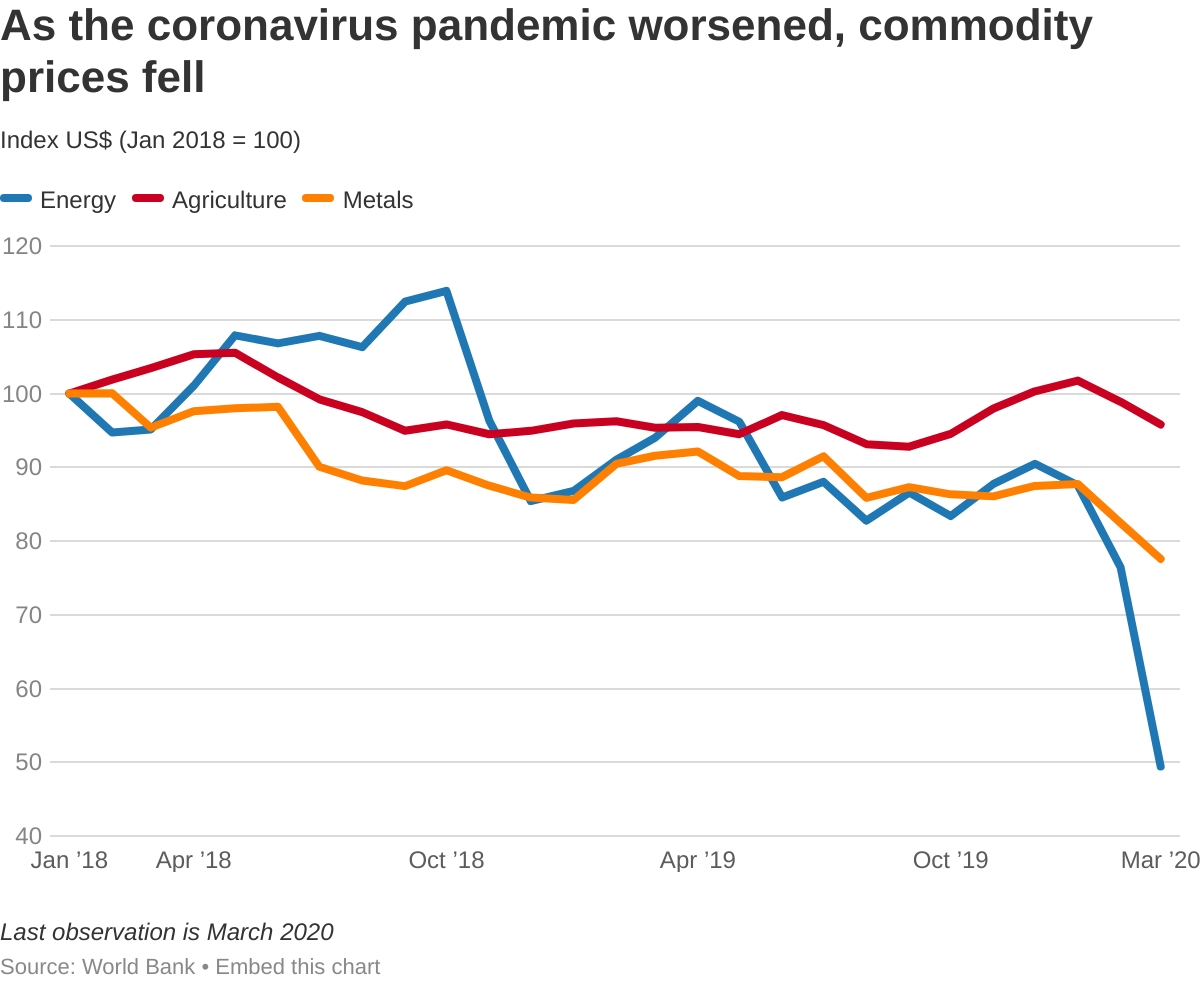

until it is contained. The collapsed of world’s oil and energy consumption, was severely affected by the

The collapsed of world’s oil and energy consumption, was severely affected by the transportation, retails, and hospitality & tourism sector’s were force arrest by governments

transportation, retails, and hospitality & tourism sector’s were force arrest by governments imposed policies. The inactivity of tourism wobbles the pillar industries like bowling pins.

imposed policies. The inactivity of tourism wobbles the pillar industries like bowling pins. The crippled inflows of foreign portfolio investment as well as foreign direct investments

The crippled inflows of foreign portfolio investment as well as foreign direct investments (FDI) has triggered the PSE index to collapse, from 7000s to 4000 level, a 40% one month

(FDI) has triggered the PSE index to collapse, from 7000s to 4000 level, a 40% one month abrupt drop in mid-march to

abrupt drop in mid-march to April, simultaneously, followed by

April, simultaneously, followed by the halting of inflows of

the halting of inflows of investments from China and

investments from China and Middle East. This contributes to

Middle East. This contributes to the downward pressure on real

the downward pressure on real estate industry, especially on

estate industry, especially on residential and office segments.

residential and office segments. Before COVID19 pandemic, Real

Before COVID19 pandemic, Real estate indicators shows the

estate indicators shows the Philippine real estate market is at

Philippine real estate market is at the apex of the price curve; an

the apex of the price curve; an uninterrupted growth closed to

uninterrupted growth closed to 10 years., crisis or no crisis the real estate market is due for a healthy correction. And

10 years., crisis or no crisis the real estate market is due for a healthy correction. And these have already been anticipated and embattled by well-established companies, how to

these have already been anticipated and embattled by well-established companies, how to sail and navigate the storm. The unprecedented effect of the COVID19 pandemic that

sail and navigate the storm. The unprecedented effect of the COVID19 pandemic that originated from China is not only regional scale but global. The disruption in the country's

originated from China is not only regional scale but global. The disruption in the country's key pillar industries consequently wont spare the country mid to long term real estate

key pillar industries consequently wont spare the country mid to long term real estate prospects for growth, especially when the bigger slice of the Philippine GDP derives its

prospects for growth, especially when the bigger slice of the Philippine GDP derives its earnings from the external global market, hence, from sectors export services and

earnings from the external global market, hence, from sectors export services and business process outsourcing.

Typically, The first quarter the year is preferred by contractors as the foremost period to

business process outsourcing.

Typically, The first quarter the year is preferred by contractors as the foremost period to start construction and development because of the fair weather condition, construction

start construction and development because of the fair weather condition, construction materials usually starts to appreciate during these months, A seasoned real estate

materials usually starts to appreciate during these months, A seasoned real estate practitioner knew, the first and the last quarter of the year is the best time to buy lease

practitioner knew, the first and the last quarter of the year is the best time to buy lease and sell properties. But this year's specifically March, April, and May, real state transaction

and sell properties. But this year's specifically March, April, and May, real state transaction drops to almost zero sale. Real estate blogs, social media's seller's chat groups

drops to almost zero sale. Real estate blogs, social media's seller's chat groups conversations tells the story and validated by nation wide directives such as travel

conversations tells the story and validated by nation wide directives such as travel restriction, border closures, community quarantines to lock-downs in most part of the

restriction, border closures, community quarantines to lock-downs in most part of the metropolitans down to smaller cluster communities, It limits economic activities like selling

metropolitans down to smaller cluster communities, It limits economic activities like selling and buying. This National policy immobilized 59.7% of the total Philippine working

and buying. This National policy immobilized 59.7% of the total Philippine working population (Philippine Labor Statistics Study 2017) or 60 million populations from being

population (Philippine Labor Statistics Study 2017) or 60 million populations from being productive, (more than half of the total Philippine population) since the middle of March till

productive, (more than half of the total Philippine population) since the middle of March till May. These translate also to more than 50% of the total businesses closure of mostly small

May. These translate also to more than 50% of the total businesses closure of mostly small and medium enterprises that constitute of the country's 99.6 percent of the total private

and medium enterprises that constitute of the country's 99.6 percent of the total private sectors that contributes to 63% of the total country’s labor force. Thus, the government

sectors that contributes to 63% of the total country’s labor force. Thus, the government creates a policy atmosphere which discourage private sector to operate while battling the

creates a policy atmosphere which discourage private sector to operate while battling the pandemic and reinforcing its health system, this overturn doctrines and philosophy learned

pandemic and reinforcing its health system, this overturn doctrines and philosophy learned in economics, which is necessary in the short term.

in economics, which is necessary in the short term.  Business and employment growth signifies a healthy economy. Manpower is crucial to

Business and employment growth signifies a healthy economy. Manpower is crucial to growth and is integral part of the business sector consequently; manpower correlates on a

growth and is integral part of the business sector consequently; manpower correlates on a production that plays the main part of the supply chains of commodities. And therefore

production that plays the main part of the supply chains of commodities. And therefore fuels the engines of growth that contributes to the Gross Domestic Product; Industrial

fuels the engines of growth that contributes to the Gross Domestic Product; Industrial commodities e.g. Power and Mining, Services e.g. BPO, POGO, Remittance, Agriculture,

commodities e.g. Power and Mining, Services e.g. BPO, POGO, Remittance, Agriculture, and Tourism.

and Tourism. Resilience of the Philippine Economy, Fiscal Position amidst COVID19

Late last year, the Philippines was on the highest peak of economic progress. As the

Resilience of the Philippine Economy, Fiscal Position amidst COVID19

Late last year, the Philippines was on the highest peak of economic progress. As the country’s economy was awarded its first (BBB+) credit rating by Fitch, after the two rating

country’s economy was awarded its first (BBB+) credit rating by Fitch, after the two rating agencies; S&P and Moody's precede in awarding its first investment grade. Despite the

agencies; S&P and Moody's precede in awarding its first investment grade. Despite the shocks experience at the beginning of the year cause by Taal Volcano eruptions, the

shocks experience at the beginning of the year cause by Taal Volcano eruptions, the country's resilience on natural calamities cushions the collateral effect on the country's

country's resilience on natural calamities cushions the collateral effect on the country's 2/3s GDP (Luzon). The countries

2/3s GDP (Luzon). The countries Build, Build, Build program

Build, Build, Build program positive economic impact did

positive economic impact did such prestigious financial grade,

such prestigious financial grade, elevating the country's

elevating the country's prospects to positive outlook.

prospects to positive outlook. More development projects were

More development projects were on the pipelines as the country

on the pipelines as the country is addressing its infrastructure

is addressing its infrastructure gap; lessen poverty, embracing

gap; lessen poverty, embracing the sustainable development

the sustainable development mechanism; enforcing its

mechanism; enforcing its position as one of the Asia's

position as one of the Asia's emerging economies. As the

emerging economies. As the economic barometers shows more positive signs, including the latest OFWs remittance

economic barometers shows more positive signs, including the latest OFWs remittance strong contribution. (in first 2 months by 4.6% increase from the previous year).

strong contribution. (in first 2 months by 4.6% increase from the previous year).  The Philippine GDP contracts 0.2%, in the first quarter of the year after COVID19

The Philippine GDP contracts 0.2%, in the first quarter of the year after COVID19 pandemic decimated global demand; impedes economic activities and disrupt supply

pandemic decimated global demand; impedes economic activities and disrupt supply chains. More indicators points to downward trend as merchandise trade figures from April

chains. More indicators points to downward trend as merchandise trade figures from April starts to show up particularly by the collapse of oil prices in the world market.

starts to show up particularly by the collapse of oil prices in the world market.  The Philippine has one of the highest financial strength amongst emerging economies in

The Philippine has one of the highest financial strength amongst emerging economies in the world according to the London based publication, “Economist”, with the lowest external

the world according to the London based publication, “Economist”, with the lowest external debt in ASEAN of 72.3 Billion Dollar, second to Indonesia and with the Debt to GDP ratio of

debt in ASEAN of 72.3 Billion Dollar, second to Indonesia and with the Debt to GDP ratio of 0.46 or 46%. The 275 billion pesos stimulus to counteract the initial effect of COVID19

0.46 or 46%. The 275 billion pesos stimulus to counteract the initial effect of COVID19 pandemic would result into 0.494 debts to GDP ratio or 0.034 increase. Assuming no

pandemic would result into 0.494 debts to GDP ratio or 0.034 increase. Assuming no financial external aid cometh; a trillion pesos total budget the total amount as initially

financial external aid cometh; a trillion pesos total budget the total amount as initially recommended by National Economic Development Authority (NEDA) from the early period

recommended by National Economic Development Authority (NEDA) from the early period of the pandemic escalations result to (d/GDP) Debt to GDP ratio of 0.587 or 58.7% of the

of the pandemic escalations result to (d/GDP) Debt to GDP ratio of 0.587 or 58.7% of the Total Gross Domestic Product. This is still healthy as compare to Singapore with the debt

Total Gross Domestic Product. This is still healthy as compare to Singapore with the debt to GDP of 110% and the US with 108%. The Philippine foreign debt is 33% and 67%

to GDP of 110% and the US with 108%. The Philippine foreign debt is 33% and 67% domestic. This suggests that the Philippines own most of its debt and have a lot of leeway

domestic. This suggests that the Philippines own most of its debt and have a lot of leeway in securing funds to finance the pandemic damages and future investments on

in securing funds to finance the pandemic damages and future investments on infrastructure projects.

Philippine Economic Strategy

The government will have to forego any growth targets, and will need to borrow funds to

infrastructure projects.

Philippine Economic Strategy

The government will have to forego any growth targets, and will need to borrow funds to augment its financial capacity. Similarly, it will need to relax its deficit target to allow for

augment its financial capacity. Similarly, it will need to relax its deficit target to allow for greater deficit spending. However, the impact of the pandemic is expected to persist in the

greater deficit spending. However, the impact of the pandemic is expected to persist in the long-term, with a long period of recessions on global scale. To this end, the Philippine

long-term, with a long period of recessions on global scale. To this end, the Philippine government will need to implement a debt-financed economic growth strategy over the

government will need to implement a debt-financed economic growth strategy over the next 2 or 3 years. Within that period, the productivity that is expected from the proposed

next 2 or 3 years. Within that period, the productivity that is expected from the proposed structural transition will be forthcoming.

structural transition will be forthcoming.  In 2019 the Philippines has a fiscal deficit expenditures exceed revenue by 660.2 Billion

In 2019 the Philippines has a fiscal deficit expenditures exceed revenue by 660.2 Billion Pesos up 18.3% from 558.3 Billion gap recorded 2018 according to bureau of treasury. The

Pesos up 18.3% from 558.3 Billion gap recorded 2018 according to bureau of treasury. The deficit was equivalent to 3.55% of GDP in 2019-overshooting the 3.25% target of the year.

deficit was equivalent to 3.55% of GDP in 2019-overshooting the 3.25% target of the year. Economic managers estimated that the fiscal deficit in 2020 may widen to as much as

Economic managers estimated that the fiscal deficit in 2020 may widen to as much as 5.3% of the Gross Domestic Product. But inflation projection is expected to kick-in at only

5.3% of the Gross Domestic Product. But inflation projection is expected to kick-in at only 2.2% in 2020 and 2.4% in 2021 as reported by ADB, within the tolerable range of 2% to

2.2% in 2020 and 2.4% in 2021 as reported by ADB, within the tolerable range of 2% to 4%. The Philippine solid banking sector and high foreign exchange reserves (high

4%. The Philippine solid banking sector and high foreign exchange reserves (high exchange rate) supports the country solid fiscal position, for the Philippine is more a net

exchange rate) supports the country solid fiscal position, for the Philippine is more a net importer than exporter a sign that the country has a solid domestic demand, a consumer’s

importer than exporter a sign that the country has a solid domestic demand, a consumer’s economy which is sustainable inclusive growth.

economy which is sustainable inclusive growth. Conclusion

The Philippine development plans has been derailed by COVID19 Pandemic but the

Conclusion

The Philippine development plans has been derailed by COVID19 Pandemic but the country’s existing infrastructure development projects through the administration's flagship

country’s existing infrastructure development projects through the administration's flagship Build, Build, Build, program will play the key rule in the country's economic recovery with

Build, Build, Build, program will play the key rule in the country's economic recovery with adjustments for more Public Private Partnership arrangements especially on “Agriculture” -

adjustments for more Public Private Partnership arrangements especially on “Agriculture” - the backbone of the economy in the 70 and 80s, To sustain inclusive growth, promote and

the backbone of the economy in the 70 and 80s, To sustain inclusive growth, promote and solicits for public infrastructure, entice private sectors to participate. In turn, minimizing

solicits for public infrastructure, entice private sectors to participate. In turn, minimizing the country's external debt ratio, thus regaining lost growth in post-COVID19 and back to

the country's external debt ratio, thus regaining lost growth in post-COVID19 and back to its economic tract. With the latest upgrade from BBB+ to A by the Japan Credit Agency

its economic tract. With the latest upgrade from BBB+ to A by the Japan Credit Agency and the forecast growth greater than 6% for the country by 2021 by the Asian

and the forecast growth greater than 6% for the country by 2021 by the Asian Development Bank (ADB). These validate the credence for a fast and strong economic

Development Bank (ADB). These validate the credence for a fast and strong economic recovery. However, the government should tackle first its health system gap and embarks

recovery. However, the government should tackle first its health system gap and embarks on a long term strategies, amend development plans as we leapfrog towards towards

on a long term strategies, amend development plans as we leapfrog towards towards digital economy and grapple with all the scenarios including the worst effect of the

digital economy and grapple with all the scenarios including the worst effect of the pandemic.

pandemic.

growth, most will be assessing and restructuring their financial standings, repayment of

growth, most will be assessing and restructuring their financial standings, repayment of financial obligations and liquidity shall be every ones priority. Banks and financial

financial obligations and liquidity shall be every ones priority. Banks and financial institutions flooded by loans and real estate mortgages were expected thereafter.

institutions flooded by loans and real estate mortgages were expected thereafter. Furthermore, health security consciousness, risk of deflation and/or inflation of

Furthermore, health security consciousness, risk of deflation and/or inflation of commodities, the distrust of equities and investments were likely to happen and

commodities, the distrust of equities and investments were likely to happen and ingratiated the slow growth. After taking the initial beating from the COVID19 pandemic

ingratiated the slow growth. After taking the initial beating from the COVID19 pandemic that transmuted into health crisis; restricted social mobility and economic fallouts from

that transmuted into health crisis; restricted social mobility and economic fallouts from imposed mitigations.

imposed mitigations.  The Philippine economy suffers from

The Philippine economy suffers from financial a shock that shrinks its GDP

financial a shock that shrinks its GDP by 0.2% in the first quarter of 2020.

by 0.2% in the first quarter of 2020. The highest contraction in more than

The highest contraction in more than two decades, surpassing two

two decades, surpassing two economic crises; Asian Financial crisis

economic crises; Asian Financial crisis 1998 and 2008 collapsed of derivative

1998 and 2008 collapsed of derivative CDO (collateralize debt obligation)

CDO (collateralize debt obligation) also known as the Sub-prime

also known as the Sub-prime Mortgage collapsed that triggered the

Mortgage collapsed that triggered the global financial crisis. Subsequently,

global financial crisis. Subsequently, the New York based Fitch rating

the New York based Fitch rating lowered the Philippine credit rating

lowered the Philippine credit rating from investment grade (BBB+) to

from investment grade (BBB+) to stable (BBB). Initially during Pre-

stable (BBB). Initially during Pre- pandemic the International Monetary

pandemic the International Monetary Fund had a high hopes for the

Fund had a high hopes for the Philippine economy to reach 6.3%,

Philippine economy to reach 6.3%, but may enough be lucky to have the

but may enough be lucky to have the upper bound projection of 2% (ADB), as the pandemic looms, since the ASEAN 5 average

upper bound projection of 2% (ADB), as the pandemic looms, since the ASEAN 5 average GDP projection was only -0.6% by IMF. Fitch states the downgrade reflects the

GDP projection was only -0.6% by IMF. Fitch states the downgrade reflects the deterioration in the country short term macro economic and fiscal outlook as result of

deterioration in the country short term macro economic and fiscal outlook as result of country's pandemic mitigations. But, does the Philippines prepared for the subsequent long

country's pandemic mitigations. But, does the Philippines prepared for the subsequent long term impact of COVID19 in the Real estate Industry and economy?

term impact of COVID19 in the Real estate Industry and economy?  Bangko Sentral ng Pilipinas Governor Benhamin Diokno said "Structural reforms and sound

Bangko Sentral ng Pilipinas Governor Benhamin Diokno said "Structural reforms and sound economic management over the years have provided us with monetary and fiscal space to

economic management over the years have provided us with monetary and fiscal space to safeguard lives and support livelihoods at this critical time". The last decade was slow but

safeguard lives and support livelihoods at this critical time". The last decade was slow but steady and interrupted economic growth in the Philippines, with controlled inflation and

steady and interrupted economic growth in the Philippines, with controlled inflation and rising employment. The economic progress was supported visually by the distinctive

rising employment. The economic progress was supported visually by the distinctive attribution to the Metropolitans Skylines. Fundamentally, the Philippine real estate market,

attribution to the Metropolitans Skylines. Fundamentally, the Philippine real estate market, was at the end of economic cycle before the pandemic devastates the economy and is due

was at the end of economic cycle before the pandemic devastates the economy and is due for a healthy corrections in-symmetry with its regional neighbours. These are our insights

for a healthy corrections in-symmetry with its regional neighbours. These are our insights at the start of the period of New Business period in 2020, when the clock starts while the

at the start of the period of New Business period in 2020, when the clock starts while the country is building resilience to adapt the new normal in the midst of the pandemic.

country is building resilience to adapt the new normal in the midst of the pandemic. Real Estate, Financial market and Industries Implications from COVID19

The Real estate Industry before the start of the 1st quarter 2020 is marked by strong

Real Estate, Financial market and Industries Implications from COVID19

The Real estate Industry before the start of the 1st quarter 2020 is marked by strong growth for most segments, supported by gradual increase of supply and strong demand

growth for most segments, supported by gradual increase of supply and strong demand (as indicated in by the Real Estate price index),but are at peril from contraction or slow

(as indicated in by the Real Estate price index),but are at peril from contraction or slow growth in the coming months; demands are expected to plunges in short term but would

growth in the coming months; demands are expected to plunges in short term but would bounce and would steadily increase in the long run, the prices will stabilize more or less at

bounce and would steadily increase in the long run, the prices will stabilize more or less at its current value. Rental units vacancy were expected to rise and vacancy rates are

its current value. Rental units vacancy were expected to rise and vacancy rates are anticipated to stabilize or discounted in a short term till the last quarter except for

anticipated to stabilize or discounted in a short term till the last quarter except for residential in urban vicinities., As

residential in urban vicinities., As mentioned earlier the liquidity is

mentioned earlier the liquidity is a prime objectives after

a prime objectives after community quarantine most

community quarantine most individuals and businesses

individuals and businesses strained from financial stress

strained from financial stress shall dispose the more saleable,

shall dispose the more saleable, tangible, none performing assets

tangible, none performing assets and secondary properties that are

and secondary properties that are viable for disposition. And thence,

viable for disposition. And thence, post-GCQ is the best time to

post-GCQ is the best time to acquire land and distress

acquire land and distress properties for real property

properties for real property bankers and investors.

At the restart of the economy, most of the industries from small to large enterprises will

bankers and investors.

At the restart of the economy, most of the industries from small to large enterprises will start to re-evaluate their financial standings. New loans and mortgages will overwhelm

start to re-evaluate their financial standings. New loans and mortgages will overwhelm banks, financial restructuring, and merging, corporate downsizing and buy outs were likely

banks, financial restructuring, and merging, corporate downsizing and buy outs were likely depending on the duration of the pandemic and its aftermaths. And the effect on

depending on the duration of the pandemic and its aftermaths. And the effect on employment won't be spared. These valuable insights show how the markets behave from

employment won't be spared. These valuable insights show how the markets behave from the after-effect of the past financial crises. However, the severity of the present crisis will

the after-effect of the past financial crises. However, the severity of the present crisis will determine on the magnitude of damage, the longevity and government counter measures

determine on the magnitude of damage, the longevity and government counter measures until it is contained.

until it is contained. The collapsed of world’s oil and energy consumption, was severely affected by the

The collapsed of world’s oil and energy consumption, was severely affected by the transportation, retails, and hospitality & tourism sector’s were force arrest by governments

transportation, retails, and hospitality & tourism sector’s were force arrest by governments imposed policies. The inactivity of tourism wobbles the pillar industries like bowling pins.

imposed policies. The inactivity of tourism wobbles the pillar industries like bowling pins. The crippled inflows of foreign portfolio investment as well as foreign direct investments

The crippled inflows of foreign portfolio investment as well as foreign direct investments (FDI) has triggered the PSE index to collapse, from 7000s to 4000 level, a 40% one month

(FDI) has triggered the PSE index to collapse, from 7000s to 4000 level, a 40% one month abrupt drop in mid-march to

abrupt drop in mid-march to April, simultaneously, followed by

April, simultaneously, followed by the halting of inflows of

the halting of inflows of investments from China and

investments from China and Middle East. This contributes to

Middle East. This contributes to the downward pressure on real

the downward pressure on real estate industry, especially on

estate industry, especially on residential and office segments.

residential and office segments. Before COVID19 pandemic, Real

Before COVID19 pandemic, Real estate indicators shows the

estate indicators shows the Philippine real estate market is at

Philippine real estate market is at the apex of the price curve; an

the apex of the price curve; an uninterrupted growth closed to

uninterrupted growth closed to 10 years., crisis or no crisis the real estate market is due for a healthy correction. And

10 years., crisis or no crisis the real estate market is due for a healthy correction. And these have already been anticipated and embattled by well-established companies, how to

these have already been anticipated and embattled by well-established companies, how to sail and navigate the storm. The unprecedented effect of the COVID19 pandemic that

sail and navigate the storm. The unprecedented effect of the COVID19 pandemic that originated from China is not only regional scale but global. The disruption in the country's

originated from China is not only regional scale but global. The disruption in the country's key pillar industries consequently wont spare the country mid to long term real estate

key pillar industries consequently wont spare the country mid to long term real estate prospects for growth, especially when the bigger slice of the Philippine GDP derives its

prospects for growth, especially when the bigger slice of the Philippine GDP derives its earnings from the external global market, hence, from sectors export services and

earnings from the external global market, hence, from sectors export services and business process outsourcing.

Typically, The first quarter the year is preferred by contractors as the foremost period to

business process outsourcing.

Typically, The first quarter the year is preferred by contractors as the foremost period to start construction and development because of the fair weather condition, construction

start construction and development because of the fair weather condition, construction materials usually starts to appreciate during these months, A seasoned real estate

materials usually starts to appreciate during these months, A seasoned real estate practitioner knew, the first and the last quarter of the year is the best time to buy lease

practitioner knew, the first and the last quarter of the year is the best time to buy lease and sell properties. But this year's specifically March, April, and May, real state transaction

and sell properties. But this year's specifically March, April, and May, real state transaction drops to almost zero sale. Real estate blogs, social media's seller's chat groups

drops to almost zero sale. Real estate blogs, social media's seller's chat groups conversations tells the story and validated by nation wide directives such as travel

conversations tells the story and validated by nation wide directives such as travel restriction, border closures, community quarantines to lock-downs in most part of the

restriction, border closures, community quarantines to lock-downs in most part of the metropolitans down to smaller cluster communities, It limits economic activities like selling

metropolitans down to smaller cluster communities, It limits economic activities like selling and buying. This National policy immobilized 59.7% of the total Philippine working

and buying. This National policy immobilized 59.7% of the total Philippine working population (Philippine Labor Statistics Study 2017) or 60 million populations from being

population (Philippine Labor Statistics Study 2017) or 60 million populations from being productive, (more than half of the total Philippine population) since the middle of March till

productive, (more than half of the total Philippine population) since the middle of March till May. These translate also to more than 50% of the total businesses closure of mostly small

May. These translate also to more than 50% of the total businesses closure of mostly small and medium enterprises that constitute of the country's 99.6 percent of the total private

and medium enterprises that constitute of the country's 99.6 percent of the total private sectors that contributes to 63% of the total country’s labor force. Thus, the government

sectors that contributes to 63% of the total country’s labor force. Thus, the government creates a policy atmosphere which discourage private sector to operate while battling the

creates a policy atmosphere which discourage private sector to operate while battling the pandemic and reinforcing its health system, this overturn doctrines and philosophy learned

pandemic and reinforcing its health system, this overturn doctrines and philosophy learned in economics, which is necessary in the short term.

in economics, which is necessary in the short term.  Business and employment growth signifies a healthy economy. Manpower is crucial to

Business and employment growth signifies a healthy economy. Manpower is crucial to growth and is integral part of the business sector consequently; manpower correlates on a

growth and is integral part of the business sector consequently; manpower correlates on a production that plays the main part of the supply chains of commodities. And therefore

production that plays the main part of the supply chains of commodities. And therefore fuels the engines of growth that contributes to the Gross Domestic Product; Industrial

fuels the engines of growth that contributes to the Gross Domestic Product; Industrial commodities e.g. Power and Mining, Services e.g. BPO, POGO, Remittance, Agriculture,

commodities e.g. Power and Mining, Services e.g. BPO, POGO, Remittance, Agriculture, and Tourism.

and Tourism. Resilience of the Philippine Economy, Fiscal Position amidst COVID19

Late last year, the Philippines was on the highest peak of economic progress. As the

Resilience of the Philippine Economy, Fiscal Position amidst COVID19

Late last year, the Philippines was on the highest peak of economic progress. As the country’s economy was awarded its first (BBB+) credit rating by Fitch, after the two rating

country’s economy was awarded its first (BBB+) credit rating by Fitch, after the two rating agencies; S&P and Moody's precede in awarding its first investment grade. Despite the

agencies; S&P and Moody's precede in awarding its first investment grade. Despite the shocks experience at the beginning of the year cause by Taal Volcano eruptions, the

shocks experience at the beginning of the year cause by Taal Volcano eruptions, the country's resilience on natural calamities cushions the collateral effect on the country's

country's resilience on natural calamities cushions the collateral effect on the country's 2/3s GDP (Luzon). The countries

2/3s GDP (Luzon). The countries Build, Build, Build program

Build, Build, Build program positive economic impact did

positive economic impact did such prestigious financial grade,

such prestigious financial grade, elevating the country's

elevating the country's prospects to positive outlook.

prospects to positive outlook. More development projects were

More development projects were on the pipelines as the country

on the pipelines as the country is addressing its infrastructure

is addressing its infrastructure gap; lessen poverty, embracing

gap; lessen poverty, embracing the sustainable development

the sustainable development mechanism; enforcing its

mechanism; enforcing its position as one of the Asia's

position as one of the Asia's emerging economies. As the

emerging economies. As the economic barometers shows more positive signs, including the latest OFWs remittance

economic barometers shows more positive signs, including the latest OFWs remittance strong contribution. (in first 2 months by 4.6% increase from the previous year).

strong contribution. (in first 2 months by 4.6% increase from the previous year).  The Philippine GDP contracts 0.2%, in the first quarter of the year after COVID19

The Philippine GDP contracts 0.2%, in the first quarter of the year after COVID19 pandemic decimated global demand; impedes economic activities and disrupt supply

pandemic decimated global demand; impedes economic activities and disrupt supply chains. More indicators points to downward trend as merchandise trade figures from April

chains. More indicators points to downward trend as merchandise trade figures from April starts to show up particularly by the collapse of oil prices in the world market.

starts to show up particularly by the collapse of oil prices in the world market.  The Philippine has one of the highest financial strength amongst emerging economies in

The Philippine has one of the highest financial strength amongst emerging economies in the world according to the London based publication, “Economist”, with the lowest external

the world according to the London based publication, “Economist”, with the lowest external debt in ASEAN of 72.3 Billion Dollar, second to Indonesia and with the Debt to GDP ratio of

debt in ASEAN of 72.3 Billion Dollar, second to Indonesia and with the Debt to GDP ratio of 0.46 or 46%. The 275 billion pesos stimulus to counteract the initial effect of COVID19

0.46 or 46%. The 275 billion pesos stimulus to counteract the initial effect of COVID19 pandemic would result into 0.494 debts to GDP ratio or 0.034 increase. Assuming no

pandemic would result into 0.494 debts to GDP ratio or 0.034 increase. Assuming no financial external aid cometh; a trillion pesos total budget the total amount as initially

financial external aid cometh; a trillion pesos total budget the total amount as initially recommended by National Economic Development Authority (NEDA) from the early period

recommended by National Economic Development Authority (NEDA) from the early period of the pandemic escalations result to (d/GDP) Debt to GDP ratio of 0.587 or 58.7% of the

of the pandemic escalations result to (d/GDP) Debt to GDP ratio of 0.587 or 58.7% of the Total Gross Domestic Product. This is still healthy as compare to Singapore with the debt

Total Gross Domestic Product. This is still healthy as compare to Singapore with the debt to GDP of 110% and the US with 108%. The Philippine foreign debt is 33% and 67%

to GDP of 110% and the US with 108%. The Philippine foreign debt is 33% and 67% domestic. This suggests that the Philippines own most of its debt and have a lot of leeway

domestic. This suggests that the Philippines own most of its debt and have a lot of leeway in securing funds to finance the pandemic damages and future investments on

in securing funds to finance the pandemic damages and future investments on infrastructure projects.

Philippine Economic Strategy

The government will have to forego any growth targets, and will need to borrow funds to

infrastructure projects.

Philippine Economic Strategy

The government will have to forego any growth targets, and will need to borrow funds to augment its financial capacity. Similarly, it will need to relax its deficit target to allow for

augment its financial capacity. Similarly, it will need to relax its deficit target to allow for greater deficit spending. However, the impact of the pandemic is expected to persist in the

greater deficit spending. However, the impact of the pandemic is expected to persist in the long-term, with a long period of recessions on global scale. To this end, the Philippine

long-term, with a long period of recessions on global scale. To this end, the Philippine government will need to implement a debt-financed economic growth strategy over the

government will need to implement a debt-financed economic growth strategy over the next 2 or 3 years. Within that period, the productivity that is expected from the proposed

next 2 or 3 years. Within that period, the productivity that is expected from the proposed structural transition will be forthcoming.

structural transition will be forthcoming.  In 2019 the Philippines has a fiscal deficit expenditures exceed revenue by 660.2 Billion

In 2019 the Philippines has a fiscal deficit expenditures exceed revenue by 660.2 Billion Pesos up 18.3% from 558.3 Billion gap recorded 2018 according to bureau of treasury. The

Pesos up 18.3% from 558.3 Billion gap recorded 2018 according to bureau of treasury. The deficit was equivalent to 3.55% of GDP in 2019-overshooting the 3.25% target of the year.

deficit was equivalent to 3.55% of GDP in 2019-overshooting the 3.25% target of the year. Economic managers estimated that the fiscal deficit in 2020 may widen to as much as

Economic managers estimated that the fiscal deficit in 2020 may widen to as much as 5.3% of the Gross Domestic Product. But inflation projection is expected to kick-in at only

5.3% of the Gross Domestic Product. But inflation projection is expected to kick-in at only 2.2% in 2020 and 2.4% in 2021 as reported by ADB, within the tolerable range of 2% to

2.2% in 2020 and 2.4% in 2021 as reported by ADB, within the tolerable range of 2% to 4%. The Philippine solid banking sector and high foreign exchange reserves (high

4%. The Philippine solid banking sector and high foreign exchange reserves (high exchange rate) supports the country solid fiscal position, for the Philippine is more a net

exchange rate) supports the country solid fiscal position, for the Philippine is more a net importer than exporter a sign that the country has a solid domestic demand, a consumer’s

importer than exporter a sign that the country has a solid domestic demand, a consumer’s economy which is sustainable inclusive growth.

economy which is sustainable inclusive growth. Conclusion

The Philippine development plans has been derailed by COVID19 Pandemic but the

Conclusion

The Philippine development plans has been derailed by COVID19 Pandemic but the country’s existing infrastructure development projects through the administration's flagship

country’s existing infrastructure development projects through the administration's flagship Build, Build, Build, program will play the key rule in the country's economic recovery with

Build, Build, Build, program will play the key rule in the country's economic recovery with adjustments for more Public Private Partnership arrangements especially on “Agriculture” -

adjustments for more Public Private Partnership arrangements especially on “Agriculture” - the backbone of the economy in the 70 and 80s, To sustain inclusive growth, promote and

the backbone of the economy in the 70 and 80s, To sustain inclusive growth, promote and solicits for public infrastructure, entice private sectors to participate. In turn, minimizing

solicits for public infrastructure, entice private sectors to participate. In turn, minimizing the country's external debt ratio, thus regaining lost growth in post-COVID19 and back to

the country's external debt ratio, thus regaining lost growth in post-COVID19 and back to its economic tract. With the latest upgrade from BBB+ to A by the Japan Credit Agency

its economic tract. With the latest upgrade from BBB+ to A by the Japan Credit Agency and the forecast growth greater than 6% for the country by 2021 by the Asian

and the forecast growth greater than 6% for the country by 2021 by the Asian Development Bank (ADB). These validate the credence for a fast and strong economic

Development Bank (ADB). These validate the credence for a fast and strong economic recovery. However, the government should tackle first its health system gap and embarks

recovery. However, the government should tackle first its health system gap and embarks on a long term strategies, amend development plans as we leapfrog towards towards

on a long term strategies, amend development plans as we leapfrog towards towards digital economy and grapple with all the scenarios including the worst effect of the

digital economy and grapple with all the scenarios including the worst effect of the pandemic.

pandemic.

Leave a Response

The State of the Philippine Economy amidst COVID19 Pandemic [Analysis]

Your Real Estate Consultant

Questions? Call us![]() :

+639292728351 /

+639776975030

(Viber)

:

+639292728351 /

+639776975030

(Viber)

by: Eugene Catalan

Posted: June 2020

by: Eugene Catalan

Posted: June 2020