Bacolod Real Estate Blog

Bacolod real estate news, blogs, articles

and investment advices

Bacolod City News

and the World

Leave a Response

How the stock market affects Real Estate?

It’s surprising that less than 1% of the Philippine population participates in the

stock market as to date and we are the lowest in Asia. Even after years of

promotion by the stock brokers, the PSE, public listed companies and investment clubs,

Filipino seems adverse to invest in stocks., Two years ago, I obliged myself to study in the

Philippine Stock Exchange Academy, not just to learn investing and trading, but to have a

glimpse on what the stock market is, “how it affects the real estate market?” The question

starts bugging me after the US

housing crash in 2008. I was in real

estate business at that time not as a

real estate broker practitioner but as

a freelance construction consultant.

The housing crash in the US, not only

affects the real estate markets in the

US, but also creates wide spread

panic selling across contingents.

drowning the major stock markets,

such as; S&P 500, Dow Jones, in

Europe; FTSE 100, DAX, CAC 40,

that exchanges suspended trading

that so many investor were trying to unload their stocks. It also affects China’s Shanghai

Composite, the Hong Kong’s; Hang Seng, and Japan’s Nikkei. The situation was so bad in

Australia that the day was dubbed as “the Black Friday”.., While in and the Philippine Stock

Exchange, it affects my finances that I want to think of changing a career, no clients

coming despite a million house dwelling backlog in the Philippines. And it became my

mission since.., to unlock the ideas behind the question”; “How the stock market affects

Real Estate?”

It was in December 2013 when finally I got the chance to study at the Philippine Stock

Market Academy in Makati, curious and eager to learn, since studying in the PSEA is a non-

formal financial course, and was not taught in an engineering school (not yet).

We learn “why we need to invest”, we study investment instruments, introduction to bonds,

mutual funds; ETF, UITF, the money markets, commodities and much on Stocks Market;

the stocks to choose when investing and trading, using fundamental and technical analysis.

Technical Analysis gives me more attention, since it looks familiar with trigonometry and

physics it’s like a wave graph, like a sine and cosine curve. The curves and lines that

creates the graph of the PSE composite index are much influence by the investors

expectation on a particular stock, if more investors are optimistic on the market, stocks

goes up and if more investor are pessimistic, the stocks goes down. The stocks high and

lows are much driven by the investor’s confidence than its fundamental value; the quality

and quantitative value of stocks base on sales, incomes and earnings.

What I learned in the PSE

historical index graph, is that

patterns that we observe are

simply reflections of human

emotional behaviour. the stock

market, bottoms at the point

of maximum fear and not a

mind set for stock buyers

perceived point of maximum

opportunity, Stock investing

should be based on stock

fundamentals not market

conditions. There are some

more factors that affect stocks value and 20% that affects the value are based on investors

and traders anticipation - some books that Ive read. But give me a little doubt? “(Maybe

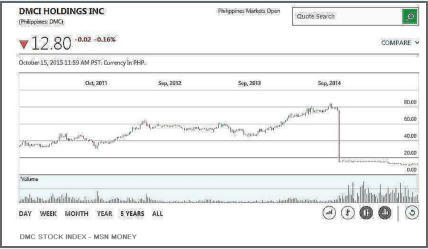

100 percent)” Example is the stock value of the Real estate arm of Consunji-led

conglomerate DMCI Holdings., On the early weeks of October 2014, the value of the stock

ranges from 70 to 80 pesos per share, News break out on 17th of October that one of its

project located in Luneta the “Torre de Manila” rumoured to be demolish for of non-

compliance and none conforming to the land use plan of the City of Manila and the National

Commission for Culture and Arts. The Condominium project creates an annoying

background to the Rizal Monument in Luneta. The following days of trading the DMCI stocks

plunges from 79 to 15 pesos per share. It lost 81% of its value cause by the investors

pessimistic action ‘panic selling’. Since then the

DMCI struggle to reach its 52 week highest stock

value since., waiting for the next bull market.

Now let’s get back to the main topic question is.,

“does the value of the real estate properties of

DMCI such as condominiums, lands and building

also devaluate at 80%?” It did not, in fact

condominiums and dwelling projects unit prices

of DMCI increases the following months by 3

percent. Without affecting their sales output.

And why is that so..? Real estate in a hedge investment, a safe haven investment during

high inflation and volatile market. As real estate brokers says “real estate does not

generally depreciates its value.” Then, how does it affect real estate..? It affects the stock’s

value of the real estate company but it does not generally affects the value of the real

estate property. The value of the stocks, affects the valuation of the buyer and the seller

who owns the stocks in the Stock Market. And it does not generally affect the fundamental

value of the company. The stock is a financial instrument issued by companies to raise

fund, to pay debts, to expands and become a public listed company.

During economic recession financial liquidity problem occurs in any financial market and it’s

hard to acquire loans to the banking institutions. because of credit requirements tightening.

Financial Investments that mostly affected were tangible assets, which are real estates.

Despite a low risk investment, real properties were mostly sold at bargain price during bad

economic conditions, because of

its low liquescency nature.

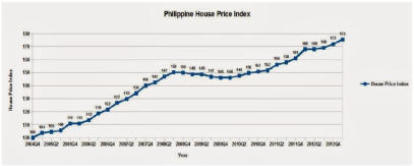

Real estate prices increases

relatively proportional to the

economic growth. If this

principle contradicts the normal

progression of economic

conditions, and that real estate

prices grow increasing and

inversely proportional to the downward trending stocks market index and the economy as a

whole. I believe the real estate bubble is likely inflating.

Your Real Estate Consultant

Questions? Call us![]() :

+639292728351 /

+639776975030

(Viber)

:

+639292728351 /

+639776975030

(Viber)

by: Eugene Catalan

Posted: October 2015

by: Eugene Catalan

Posted: October 2015