Bacolod Real Estate Blog

Bacolod real estate news, blogs, articles

and investment advices

Bacolod City News

and the World

Leave a Response

Importance of Location for Real Estate Investing

Investing for the construction of commercial building for the purpose of leasing, sometimes creates unforeseen circumstance that turns out into headache for investors Especially

creates unforeseen circumstance that turns out into headache for investors Especially when the return of investment fails to reach the target rate they were aiming,.. the Return

when the return of investment fails to reach the target rate they were aiming,.. the Return of investment turns out to be too long., thus the building owner would only rely on the

of investment turns out to be too long., thus the building owner would only rely on the appreciation of the property for a longer period then sell it for significant gains to cover the

appreciation of the property for a longer period then sell it for significant gains to cover the initial investment and interest, thus the building owner would depend on the local

initial investment and interest, thus the building owner would depend on the local economic situation where the

economic situation where the value of the property soon

value of the property soon would appreciates. But, what

would appreciates. But, what if., a different scenario come

if., a different scenario come at play where the property is

at play where the property is under mortgage and the rate

under mortgage and the rate of return could not cover the

of return could not cover the loan interest rates, because of

loan interest rates, because of the property’s occupancy rate

the property’s occupancy rate is too low to reach the ideal

is too low to reach the ideal cap-rate, thus the property is

cap-rate, thus the property is in peril of being foreclosed in

in peril of being foreclosed in the long run, In this scenario

the long run, In this scenario one of the main factor the

one of the main factor the building owner should pay

building owner should pay attention before buying the

attention before buying the land and building the structure is its location. It’s like a chess game where the players

land and building the structure is its location. It’s like a chess game where the players manoeuvre their pieces in the center, to increase the mobility and control more squares.

manoeuvre their pieces in the center, to increase the mobility and control more squares. The more squares they control the greater advantage they have, thus, “Controlling the

The more squares they control the greater advantage they have, thus, “Controlling the Center” is the main factor to get the advantage.

Center” is the main factor to get the advantage. The location of the property along the main commercial strip of the City Center or within

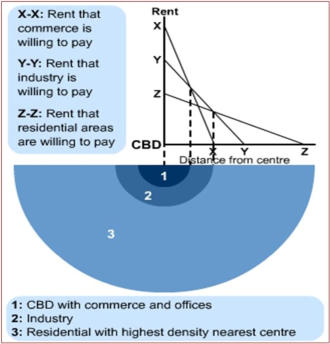

The location of the property along the main commercial strip of the City Center or within the Central Business District played a significant rule of rental properties for potential gains

the Central Business District played a significant rule of rental properties for potential gains because of its visibility to pedestrian and vehicular traffic. And that applies Alfonso

because of its visibility to pedestrian and vehicular traffic. And that applies Alfonso Principles or the Bid-Rent Theory - The nearer the property to the central business district,

Principles or the Bid-Rent Theory - The nearer the property to the central business district, the lessee or land user become more willing

the lessee or land user become more willing to pay the rent at the higher price. The

to pay the rent at the higher price. The rental rate using “One Percent Rule’ for

rental rate using “One Percent Rule’ for leasing a property in a Central Business

leasing a property in a Central Business District sometimes become too cheap for a

District sometimes become too cheap for a progressing city. Construction of

progressing city. Construction of commercial buildings were limited or

commercial buildings were limited or commercial spaces were scarce. And

commercial spaces were scarce. And therefore new comprehensive urban

therefore new comprehensive urban planning should be ratified and impose. To

planning should be ratified and impose. To convert or to reclassify to open more lands

convert or to reclassify to open more lands for commercial development or maybe

for commercial development or maybe increase height requirements to preserve

increase height requirements to preserve scarce productive and fertile agricultural

scarce productive and fertile agricultural lands. Take an example of the property I

lands. Take an example of the property I was engage a year ago by a public listed

was engage a year ago by a public listed company for a valuation of a numerous

company for a valuation of a numerous rental properties around Negros Occidental. I found out that the value of commercial space

rental properties around Negros Occidental. I found out that the value of commercial space in a Poblacion in Municipality of Hinigaran with a Zonal Value of P2,500 per sqm is almost

in a Poblacion in Municipality of Hinigaran with a Zonal Value of P2,500 per sqm is almost twice that the rental rate in Bacolod City’s Central Business area with a zonal value of

twice that the rental rate in Bacolod City’s Central Business area with a zonal value of P28,000 per sqm. Some of which rate values is almost equal to the price of a rental space

P28,000 per sqm. Some of which rate values is almost equal to the price of a rental space in a Mall, The features and the finishes are beyond comparable.

in a Mall, The features and the finishes are beyond comparable. Sorry for I haven’t divulge numerical values of the survey collected from the field and

Sorry for I haven’t divulge numerical values of the survey collected from the field and valuation computed. I am a civil engineer, plumbing engineer, environmental planner, real

valuation computed. I am a civil engineer, plumbing engineer, environmental planner, real estate broker and real estate consultant, our existence depends from the compensations

estate broker and real estate consultant, our existence depends from the compensations we received from our clients that requires our services and its not for free.

we received from our clients that requires our services and its not for free. Please visit our services page at: https://bit.ly/2oZaYbR , for the list of our provided

Please visit our services page at: https://bit.ly/2oZaYbR , for the list of our provided services.

services.

creates unforeseen circumstance that turns out into headache for investors Especially

creates unforeseen circumstance that turns out into headache for investors Especially when the return of investment fails to reach the target rate they were aiming,.. the Return

when the return of investment fails to reach the target rate they were aiming,.. the Return of investment turns out to be too long., thus the building owner would only rely on the

of investment turns out to be too long., thus the building owner would only rely on the appreciation of the property for a longer period then sell it for significant gains to cover the

appreciation of the property for a longer period then sell it for significant gains to cover the initial investment and interest, thus the building owner would depend on the local

initial investment and interest, thus the building owner would depend on the local economic situation where the

economic situation where the value of the property soon

value of the property soon would appreciates. But, what

would appreciates. But, what if., a different scenario come

if., a different scenario come at play where the property is

at play where the property is under mortgage and the rate

under mortgage and the rate of return could not cover the

of return could not cover the loan interest rates, because of

loan interest rates, because of the property’s occupancy rate

the property’s occupancy rate is too low to reach the ideal

is too low to reach the ideal cap-rate, thus the property is

cap-rate, thus the property is in peril of being foreclosed in

in peril of being foreclosed in the long run, In this scenario

the long run, In this scenario one of the main factor the

one of the main factor the building owner should pay

building owner should pay attention before buying the

attention before buying the land and building the structure is its location. It’s like a chess game where the players

land and building the structure is its location. It’s like a chess game where the players manoeuvre their pieces in the center, to increase the mobility and control more squares.

manoeuvre their pieces in the center, to increase the mobility and control more squares. The more squares they control the greater advantage they have, thus, “Controlling the

The more squares they control the greater advantage they have, thus, “Controlling the Center” is the main factor to get the advantage.

Center” is the main factor to get the advantage. The location of the property along the main commercial strip of the City Center or within

The location of the property along the main commercial strip of the City Center or within the Central Business District played a significant rule of rental properties for potential gains

the Central Business District played a significant rule of rental properties for potential gains because of its visibility to pedestrian and vehicular traffic. And that applies Alfonso

because of its visibility to pedestrian and vehicular traffic. And that applies Alfonso Principles or the Bid-Rent Theory - The nearer the property to the central business district,

Principles or the Bid-Rent Theory - The nearer the property to the central business district, the lessee or land user become more willing

the lessee or land user become more willing to pay the rent at the higher price. The

to pay the rent at the higher price. The rental rate using “One Percent Rule’ for

rental rate using “One Percent Rule’ for leasing a property in a Central Business

leasing a property in a Central Business District sometimes become too cheap for a

District sometimes become too cheap for a progressing city. Construction of

progressing city. Construction of commercial buildings were limited or

commercial buildings were limited or commercial spaces were scarce. And

commercial spaces were scarce. And therefore new comprehensive urban

therefore new comprehensive urban planning should be ratified and impose. To

planning should be ratified and impose. To convert or to reclassify to open more lands

convert or to reclassify to open more lands for commercial development or maybe

for commercial development or maybe increase height requirements to preserve

increase height requirements to preserve scarce productive and fertile agricultural

scarce productive and fertile agricultural lands. Take an example of the property I

lands. Take an example of the property I was engage a year ago by a public listed

was engage a year ago by a public listed company for a valuation of a numerous

company for a valuation of a numerous rental properties around Negros Occidental. I found out that the value of commercial space

rental properties around Negros Occidental. I found out that the value of commercial space in a Poblacion in Municipality of Hinigaran with a Zonal Value of P2,500 per sqm is almost

in a Poblacion in Municipality of Hinigaran with a Zonal Value of P2,500 per sqm is almost twice that the rental rate in Bacolod City’s Central Business area with a zonal value of

twice that the rental rate in Bacolod City’s Central Business area with a zonal value of P28,000 per sqm. Some of which rate values is almost equal to the price of a rental space

P28,000 per sqm. Some of which rate values is almost equal to the price of a rental space in a Mall, The features and the finishes are beyond comparable.

in a Mall, The features and the finishes are beyond comparable. Sorry for I haven’t divulge numerical values of the survey collected from the field and

Sorry for I haven’t divulge numerical values of the survey collected from the field and valuation computed. I am a civil engineer, plumbing engineer, environmental planner, real

valuation computed. I am a civil engineer, plumbing engineer, environmental planner, real estate broker and real estate consultant, our existence depends from the compensations

estate broker and real estate consultant, our existence depends from the compensations we received from our clients that requires our services and its not for free.

we received from our clients that requires our services and its not for free. Please visit our services page at: https://bit.ly/2oZaYbR , for the list of our provided

Please visit our services page at: https://bit.ly/2oZaYbR , for the list of our provided services.

services.

Your Real Estate Consultant

Questions? Call us![]() :

+639292728351 /

+639776975030

(Viber)

:

+639292728351 /

+639776975030

(Viber)

by: Eugene Catalan

Posted: March 2019

by: Eugene Catalan

Posted: March 2019